GM and welcome to Dove Dispatch #44!

Today, we are digging into the role played by Centralized Exchanges in the crypto fundraising lanscape.

Dove Metrics is sponsored by BarnBridge - a protocol for tokenized risk, that enables users to calibrate their exposure to different risk vectors within DeFi. Its SMART Alpha application gives you more control over exposure to the performance of digital assets.

📹 Watch What is SMART Alpha?

90% of Coinbase Ventures’ all-time capital was deployed in 2021, with an average of one deal every 2.5 days — it has quickly become one of the most active corporate venture funds in operation.

Since December 2021 only, Kraken launched a $65M fund, FTX announced a $2B venture fund and a $100M philanthropic fund, KuCoin Labs revealed a $50M accelerator, and OKCoin launched a $165M collective investment to push Bitcoin adoption.

Meanwhile, since the beginning of 2021, FTX received more than $1.8B in fresh funding from top investors.

With 55 deals and more than $4.2B raised since January 2021, the Centralized Exchange vertical represents 9.75% of the capital injected in crypto companies and 3% of the number of deals.

37.7% of the rounds were earlier than Series A and on average, $89M was raised by projects building Centralized Exchanges, compared to $26.8M for the industry overall over the last 15 months.

We have identified 27 Centralized Exchanges actively investing in crypto startups. Binance Labs, Coinbase Ventures, OKX, FTX, Blockchain.com, Huobi, MEXC Exchange, and Gemini are the most active ones.

364 fundraises announced since January 2021 were completed with the participation of at least one CEX, for a total of more than $10B raised.

20% of the funding processes since January 2021 have been completed with at least one Centralized Exchange. In comparison, in 2021, 1.3% of the fundraise comprised one or more banking groups only, and 11% comprised one investment DAO or more.

Interestingly, the average amount raised by crypto companies is $32M when at least one CEX is involved — compared to $25.6M when there is no CEX.

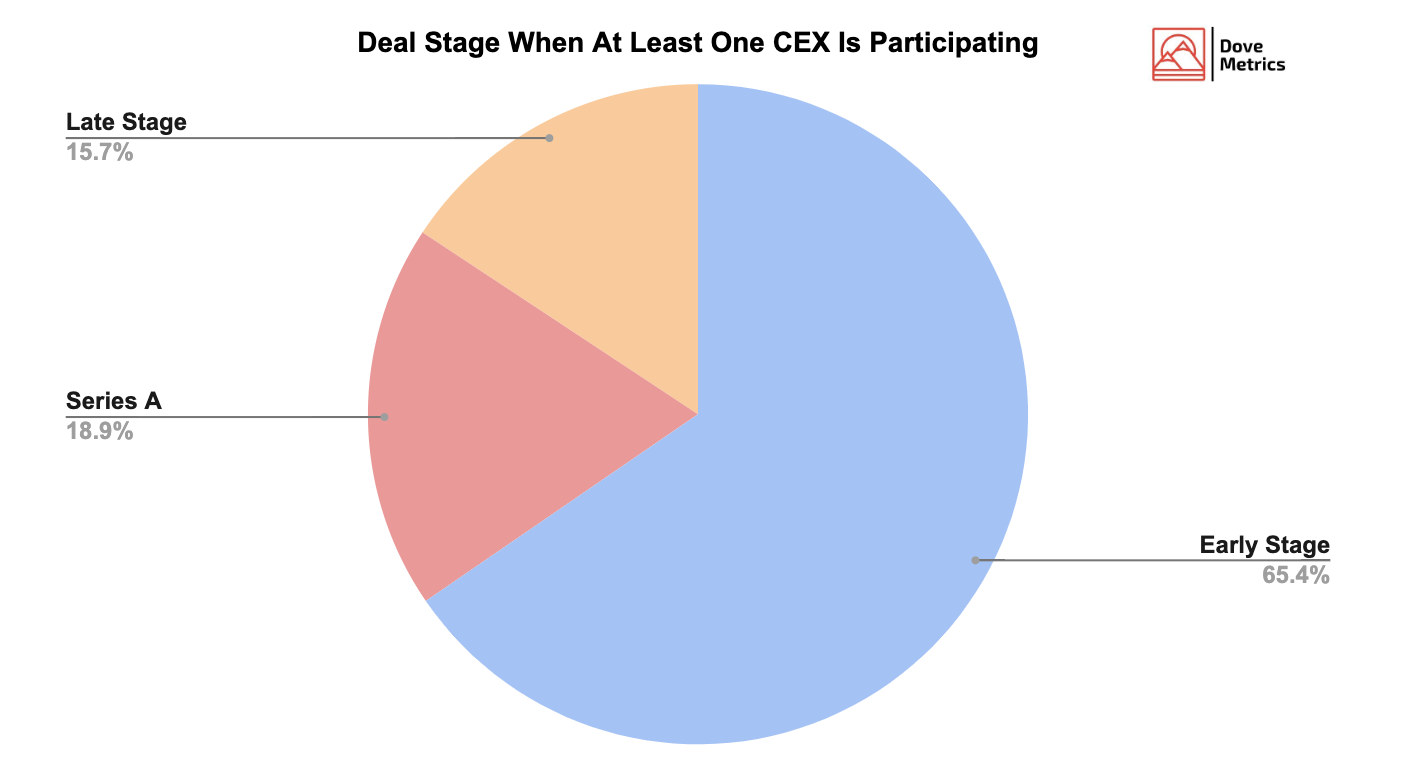

Again, data makes it clear: early-stage funding accounts for more than 65% of the announced raises.

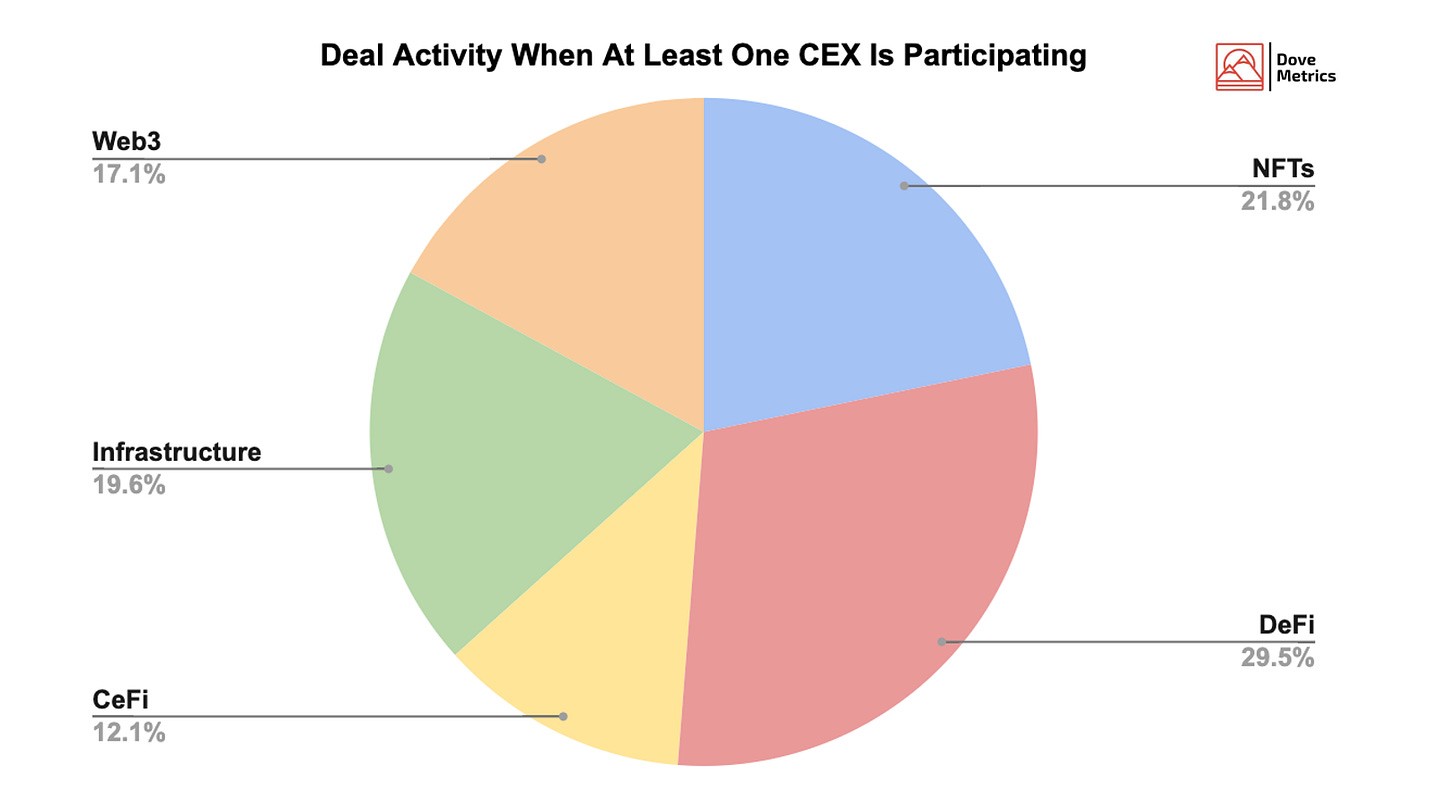

With respectively 29.5% and 21.8% of the deals, DeFi and NFTs have undoubtedly been CEX venture arms’ sweet spot so far. Participating in these deals is a privileged way for Centralizex Exchanges to get insights on what decentralized promising startups are building and potentially understand how they could integrate such services into their business.

Last week 40 projects announced fundraising rounds:

metaENGINE ($4M) | The first decentralized all-in-one platform for the development and publishing of Fi / Metaverse games and apps — with icipation from Lemniscap, Jump Crypto, Polygon Studios, Blockwall, Blufolio, DCX Ventures, Efficient Frontier, Insignius Capital, Block Brands, Future Fund, and Maelstrom Interactive.

LifeForce Games ($5M) | Metaverse-as-a-service network — with participation from Lemniscap, CMT Digital, Sfermion, Hartmann Capital, Sterling.VC, Ready Player DAO, and NeonDao.

Struct Finance ($3.9M) | Enabling structured products on DeFi — with participation from Blizzard Fund, Antler, Arcanum Capital, Assymetries Technologies, Avalaunch, AVentures DAO, Bison Fund, Bixin Ventures, Double Peak, FBG Capital, Finality Capital Partners, Infinity Ventures Crypto, Keychain Capital, Lancer Capital, LucidBlue Ventures, MC Ventures, QCP Capital, SCC Investments, SkyVision Capital, Spark Digital Capital, Wintermute, Woodstock Fund, Zokyo, and 0x Ventures.

C2X ($25M) | The blockchain gaming platform — with participation from FTX, Jump Crypto, Animoca Brands, Hashed, Terra, Transcend Fund, Galaxy Interactive, Skybound Entertainment, Blockchain Coinvestors, DeFiance Capital, Play Ventures, Crypto.com Capital, Infinity Ventures Crypto, Unanimous Capital, Bowei, Xsolla, Huobi Capital, Goal Ventures, Concept Art House, Agnitio Capital, and Formless Capital.

Eternal Dragons ($8.2M) | Dragon Game on Solana — with participation from Makers Fund, Play Ventures, and Fabric Ventures.

InvestaX | The world's leading digital securities exchange — with participation from Coinbase Ventures, Gate Ventures, Token Bay Capital, Sustainability Exchange Group, GBV Capital, Startup-O, JST Capital, Baksh Capital, Thakral Corporation, Woodside Holdings Investment Management, and Balaji Srinivasan.

Ultiverse ($4.5M) | Connecting Web3 with a VR-compatible virtual world — with participation from Binance Labs, DeFiance Capital, Three Arrows Capital, and SkyVision Capital.

AFAR ($10M) | Hilarious multiplayer battles in A FAR AWAY REALM — with participation from Dialectic Capital, Merit Circle, Dragonfly Capital, DeFiance Capital, Animoca Brands, Razer, Dapper Labs, Maven 11 Capital, Makers Fund, Gabby Dizon, Santiago R. Santos, Nick Chong, and Weak Simp Cap.

Prime Protocol ($2.75M) | Unlock the value of all your defi positions in one place — with participation from Arrington XRP Capital, Jump Capital, Framework Ventures, Skynet Trading, Pattern Research, Canonical Crypto, Anjan Vinod, Hans Tung, Joshua Lim, Noah Jessop, Chris McCann, Roshun Patel, and Jeff Kuan.

Moonwell ($10M) | An open lending and borrowing DeFi protocol on Moonbeam — with participation from Hypersphere Ventures, Arrington XRP Capital, Lemniscap, C Squared Ventures, Mirana Ventures, Woodstock Fund, Robot Ventures, Signum Capital, UOB Venture, Charterhouse Strategic Partners, Keychain Capital, FMFW, and nfr.

Itheum | World’s 1st decentralized, cross-chain data brokerage technology platform — with participation from Elrond, Ascensive Assets, Mechanism Capital, Woodstock Fund, Skynet Trading, ZBS Capital, MHC Digital Finance, and Spark Digital Capital.

LiveArtX ($4.5M) | A premium NFT platform that connects the art world with web3 — with participation from Animoca Brands, KuCoin Labs, Everest Ventures, ArkStream Capital, APENFT, Alameda Research, Appworks, BlackPine, Gate.io, Hashkey Capital, Head & Shoulder X, OKX, SNZ Holding, Shima Capital, TPS Capital, and BNB Chain.

Sturdy ($3.9M) | The first protocol for interest-free borrowing and high yield lending — with participation from Pantera Capital, Y Combinator, SoftBank, Mgnr, One Block Capital, Dialectic Capital, OrangeDAO, and KuCoin Ventures.

Rebel Bots ($2M) | The ultimate Play to Earn Game — with participation from Animoca Brands, Ubisoft, and Overwolf.

Crypto Unicorns ($26M) | A digital pet collecting and farming Game, built on blockchain — with participation from TCG, Backed, Acme Capital, BITKRAFT Ventures, Delphi Digital, Infinity Ventures Crypto, Polygon Studios, CoinFund, BreederDAO, and Emfarsis.

finblox ($3.9M) | Buy and earn up to 90% APY on your crypto — with participation from Sequoia Capital, MSA Capital, Three Arrows Capital, Dragonfly Capital, Venturra Capital, Saison Capital, CoinFund, Kyros Ventures, Ratio Ventures, First Check Ventures, OrangeDAO, Tianwei Liu, Xinshu Dong, Ron Hose, James Simpson, Quentin Vanoekel, Binh Tran, and Eddie Thai.

TravelX ($10M) | A blockchain-based distribution protocol — with participation from Borderless Capital, Algorand Foundation, Draper Cygnus, Myelin, and Monday Capital.

FreedomFi ($9.5M) | We build 5G networks based on open-source software and commodity hardware — with participation from BlueYard Capital, SamsungNext, and Qualcomm.

Float Capital ($5M) | The easiest and most efficient way to gain long or short exposure to a wide variety of assets — with participation from Alameda Research, Maven 11 Capital, IDEO Colab Ventures, MetaCartel Ventures, Encode Club, 6th Man Ventures, Ascensive Assets, Paribus Ventures, Raba Capital, Daedalus Angel Syndicate, Contango Digital Assets, Morningstar Ventures, BENQI, Fire Eyes DAO, DegenScore, CVVC, Tendex, Stani Kulechov, CJ Hetherington, Gengmo Qi, Sunil Srivatsa, Danish Chaudhry, Will Holt, Seref Beverli, and Sinan Koc.

RSTLSS ($3.5M) | Making it seamless for fashion creators to access Metaverse in a scalable way while controlling their IP — with participation from BITKRAFT Ventures, The Venture Reality Fund, Starting Line, RED DAO, Matthew Ball, Paris Hilton, Trevor McFedries, Bharat Krymo, Meltem Demirors, Kevin Lin, and Rogue Venture Partners.

Optimism ($150M) | Scalability stack for instant transactions and scalable smart contracts — with participation from Paradigm, and Andreessen Horowitz.

Kyash ($41.2M) | The first mobile-first banking services from Japan — with participation from Altos Ventures, Goodwater Capital, StepStone Group, Greyhound Capital, SMBC Nikko Securities, JAFCO, Mitsui Sumitomo Insurance Capital, Block, and Japan Post Investment Corporation.

Mina Protocol ($92M) | The world's lightest blockchain, powered by participants — with participation from FTX, Three Arrows Capital, Alan Howard, Amber Group, Blockchain.com, Brevan Howard Asset Management, Circle, Finality Capital Partners, and Pantera Capital.

Third Time ($3.5M) | Mobile/web horse-racing game — with participation from LVP, Reciprocal Ventures, Coinbase Ventures, 6th Man Ventures, Folius Ventures, Big Brain Holdings, and Maven Capital.

🙌 Thanks to our sponsors at BarnBridge

Treehouse ($18M) | The world's most comprehensive DeFi portfolio analytics platform — with participation from Mirana Ventures, Lightspeed Venture Partners, MassMutual, Binance, Bybit, Global Founders Capital, Jump Capital, Moonvault Capital, Wintermute, GSR, K3 Ventures, LeadBlock Partners, Coinhako, Bitpanda, Pintu, The Brooker Group, AlphaLab Capital, Portofino Technologies, Pulsar Trading, Fundamental Labs, CRC Capital, Berioza Associates, Venturra Capital, and Do Kwon.

Inanomo ($6M) | Helping users easily buy and sell cryptocurrencies.

Wombat Exchange ($5.2M) | Swap stablecoins at minimal slippage and stake at maximum yield — with participation from Animoca Brands, Hailstone Ventures, Binance Labs, BNB Chain, TPS Capital, GSR, Zokyo, Eureka Meta Capital, Silverstone, Unanimous Capital, Lunar Station, and Crypto Wesearch.

MetaBlox ($2M) | A Decentralized ID-enabled network with key building blocks for Web3 and Metaverse — with participation from Collab+Currency.

Hex Trust ($88M) | Through their platform, you can access liquidity providers, exchanges, and lending & staking platforms, which allows their custody clients to seamlessly access third-party services while holding assets in our highly secure and regulated platform — with participation from Animoca Brands, Liberty City Ventures, Ripple, Terra, Morgan Creek Digital, Primavera Capital, LeadBlock Partners, Eterna Capital, Sino Global Capital, Topaz Investment, Adrian Cheng, BlockFi, CoinList Seed, Protocol Labs, Pulsar Trading, Wintermute, QBN Capital, Kenetic, Hashkey Capital, Fenbushi Capital, Radiant Tech Ventures, Cell Rising, Borderless Capital, Mind Fund, Token Bay Capital, Tessera Capital Partners, Double Peak, BCW Group, MANTRA DAO, and Tessera Capital.

Formfunction ($4.7M) | The 1/1 Solana NFT marketplace, designed for independent creators — with participation from Variant, Solana Capital, Canonical Crypto, Pear VC, Palm Tree Crew, and OpenSea.

Pikaster | The first Game-Fi project created by Metaland — with participation from KuCoin Ventures.

Dave ($100M) | Mobile banking app — with participation from FTX.

Gensyn ($6.5M) | The hyperscale, cost-efficient compute protocol for the world's deep learning models — with participation from Eden Block, Galaxy Digital, Maven 11 Capital, CoinFund, Hypersphere Ventures, Zee Prime Capital, Entrepreneur First, Counterview Capital, 7percent Ventures, Id4 Ventures, and Jsquare.

NeoFi ($2.1M) | Build a diversified long-term portfolio of digital assets in a single click — with participation from Digital Strategies, BlueZilla, GHAF Capital Partners, GDA Capital, Banter Capital, Magnus Capital, Maven Capital, Contango Digital Assets, and Heslin Kim.

Joyride ($14M) | Web3 platform for game creators — with participation from Coinbase Ventures, Animoca Brands, Solana Capital, Dapper Labs, BITKRAFT Ventures, SuperLayer, Modern Times Group, Mirana Ventures, Mulana, and Matrixport.

The TIE ($9M) | The leading provider of information services for digital assets — with participation from Blizzard Fund, NYDIG, Hudson River Trading, Republic, Gemini, and Nexo.

CoinRoutes ($16M) | A crypto trading software provider — with participation from Ayon, Susquehanna International Group, Cboe FX Markets, Celsius Network, CMT Digital, Genesis, Galaxy Digital, Arca, Mirana Ventures, GSR, and AscendEX.

Divvy ($2M) | Bringing DeFi to the gambling world — with participation from Zoomer Fund, Big Brain Holdings, Bixin Ventures, Graviton Fund, NetZero Capital, Shima Capital, CSP DAO, and LD Capital.

KlayCity ($3.75M) | A P2E Game, built on the Klaytn Network, that allows users to own virtual NFT-based property on a dynamic map — with participation from Krust, Animoca Brands, Naver Z, FriendsGames, A&T Capital, OKX, GBV Capital, Kyros Ventures, ROK Capital, Stable Node, PlayDapp, HG Ventures, KuCoin Ventures, Eric Zoo, and Do Kwon.

Eizper Chain ($2M) | F2P-P2E ARPG Game set in a fantasy world with steampunk style powered by Solana — with participation from Alameda Research, Huobi Capital, Crypto.com Capital, DeFi Capital, Avocado Guild, AAG Ventures, Floem Capital, Sea Games Organization, QCP Capital, Petrock Capital, Solana Insiders, ROK Capital, CMS Holdings, Kernel Ventures, Nyan Heroes, Genopets, Arnold Poernomo, Tamar Menteshashvili, Ian Lam, Jack Teoh, NyanQueen Wengie, Solar Eco Fund, and Ivan Lam.

Dove Metrics newsletter is sponsored by BarnBridge.

BarnBridge’s SMART Alpha application was recently launched on mainnet as well as on Polygon and Avalanche. It allows users to get leverage or absolute downside protection on the asset performance. SMART Alpha achieves this by redistributing the assets of one side to the other. Seniors give assets to juniors when price performance is positive, and vice versa when price performance is negative.

📹 Watch What is SMART Alpha?

👀 Read Messari report on SMART Alpha

🕹 Play with SMART Alpha