Hello world, and welcome to Dove Dispatch #16!

Today, we are digging into traditional banks investing in crypto companies.

Dove Metrics is sponsored by The Index Coop - a community-led initiative focused on making crypto investing simple, accessible, and safe. They create and maintain the world’s best crypto index products: DeFi Pulse Index ($DPI), ETH2x-Flexible Leverage Index (ETH2x-FLI), BTC2x-Flexible Leverage Index (BTC2x-FLI), Metaverse Index ($MVI), and Bankless BED Index ($BED).

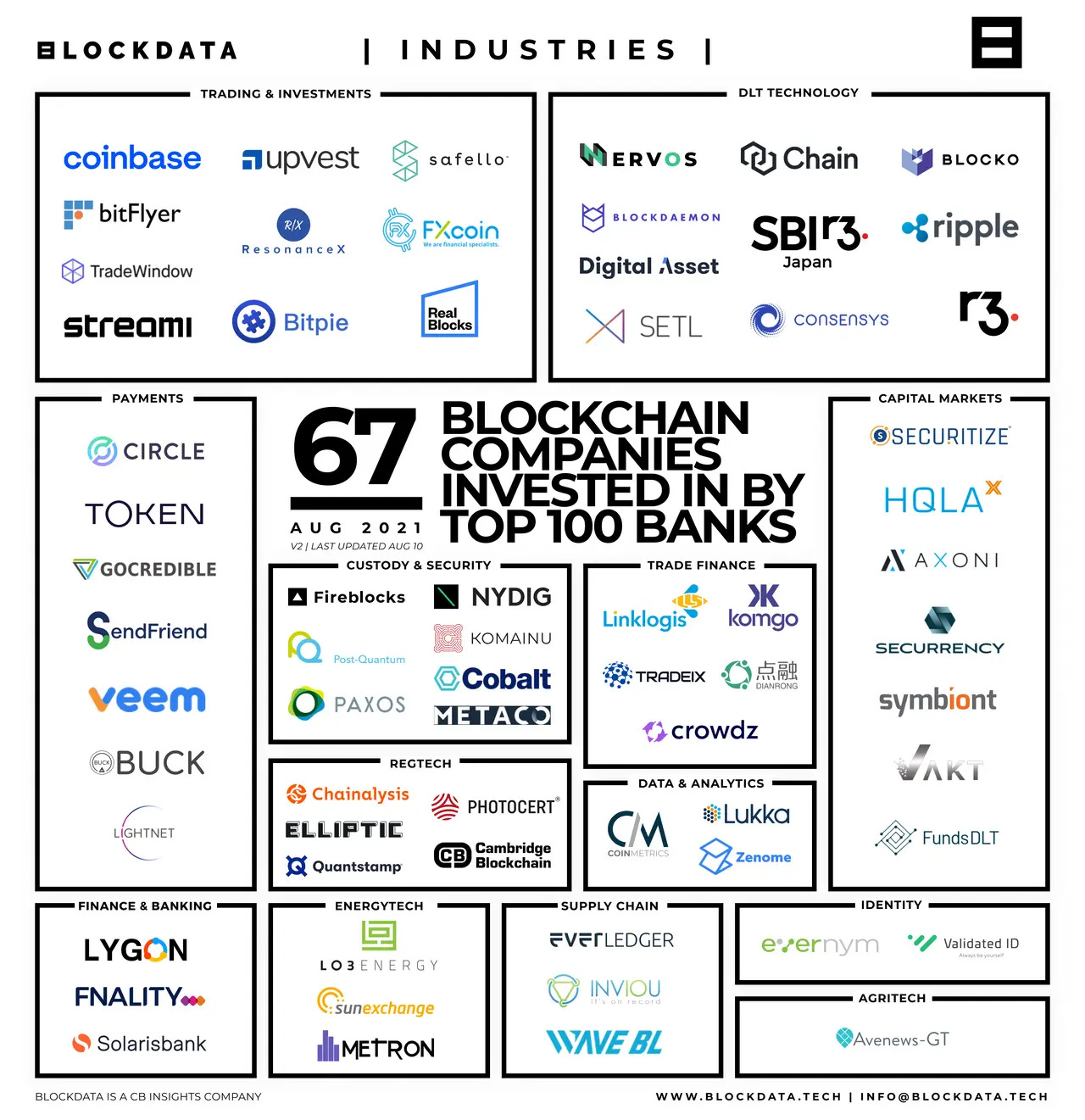

According to Blockdata, 55 of the top 100 banks by AUM have backed blockchain-based companies over the last three years. But what does it look like in 2021?

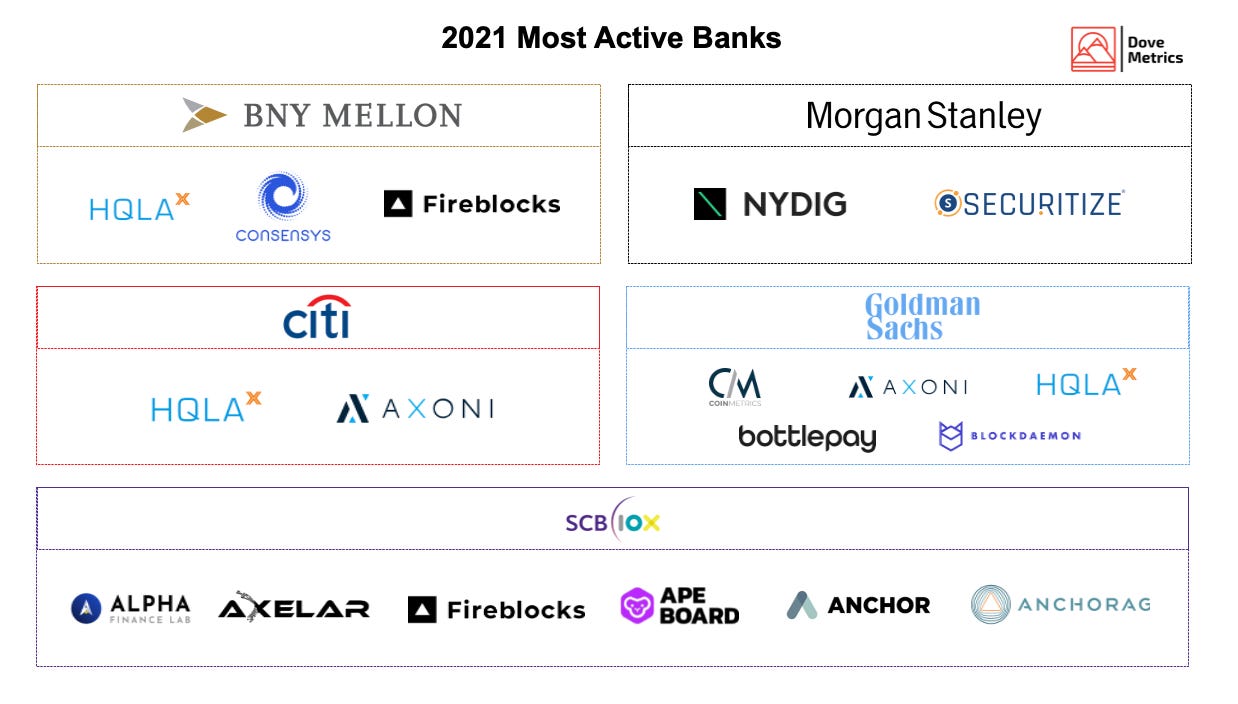

With Thailand’s biggest and oldest bank Siam Commercial Bank launching its $50M dedicated venture arm called SCB 10X to back DeFi early projects, the trend seems to be increasing. The war chest has since grown to $110M, with investments in some noteworthy projects to date (Anchorage, BlockFi, SYNQA, Ripple, Axelar, Alpha Finance Lab, Ape Board, and Fireblocks).

Looking at the crypto 2021 fundraising rounds to date, more than $700M has been raised by companies that decided to onboard at least one bank, with 10+ announced raises. It represents 4.8% of the fresh capital injected into crypto companies in 2021 and 1.3% of the total crypto-related deals reported.

As discussed in Dove Dispatch #8, a large majority of the 2021 funding processes have been completed with only crypto native funds. Zooming in, up to 14% of the rounds with at least one non-crypto native fund comprises of one or more banks.

Data makes it clear: banks are mostly participating in late-stage rounds. Seed funding accounts for less than 10% of the announced raises, and the average amount raised by crypto companies is $70M when at least one bank is involved — compared to $22M when participants are crypto-focused funds only.

There are three significant verticals traditional banks look for when they back crypto companies:

DeFi projects that have parallels with traditional finance because banks want to learn how they offer financial products in a decentralized way and try to find a way to integrate with them.

Infrastructure companies such as Axoni ($31M) raising capital from UBS, Deutsche Bank, Citi, Goldman Sachs, HSBC, J.P. Morgan, and Wells Fargo.

CeFi projects like Fireblocks completing Series C and Series D rounds with participation from BNY Mellon and SCB 10X. As many banks are building custody solutions, some chose to invest in companies directly providing them.

39% of the banks that are actively investing are located in the US, and 19% are in the United Kingdom. Another trend to look out for is banking groups supporting one or two home-based crypto projects: recently Lygon, located in Australia, raised $5M with participation from Australia and New Zealand Banking Group and Commonwealth Bank of Australia.

In the future, some banks should be moving on to the next stage by offering operational support to founders. SCB 10X is already running a validator node for Band Protocol.

Last week 4 projects announced fundraising rounds:

Apricot Finance ($4M) | A DeFi solution based on the Solona network that provides its users with excess mortgage services — with participation from Advanced Blockchain AG, SkyVision Capital, LedgerPrime, Valhalla Capital, MXC Exchange, Gate.io, a41 Ventures, Delphi Digital, Lemniscap, Solana Capital, Komorebi Collective, Bixin Ventures, CryptoJ, Struck Capital, GSR, Solar Eco Fund, Coinsights Ventures, Global Coin Research, Smrti Lab, Darren Lau, Zhuoxun Yin, Jeff Kuan, Matthew J Cantieri, and Nick Tong.

Royal ($16M) | Aiming to wed music rights with NFTs, allowing users to buy shares of songs through the company’s marketplace, earning royalties as the music they’ve invested in gains popularity — with participation from Founders Fund, Paradigm, and Atomic.

MatrixETF | The next generation of decentralized ETF platform to run the cross-chain, which goal is to establish a decentralized, automated, personalized, and diversified portfolio for users, as well as help users easily enjoy long-term, stable, and efficient financial services — with participation from Spark Digital Capital, CMS Holdings, Morningstar Ventures, Ascensive Assets, Divergence Ventures, GBV Capital, Solana Ecosystem Fund, Moonrock Capital, and AU21 Capital.

Euler ($8M) | A permissionless lending protocol with reactive interest rates — with participation from Paradigm, Lemniscap, Anthony Sassano, Ryan Adams, David Hoffman, Kain Warwick, Hasu, Danilo Carlucci, Supriyo Roy, Xin Wang, Divergence Ventures, LAUNCHub Ventures, and CMT Digital.

We have also added the following investors: Baroda Ventures, a41 Ventures, CryptoJ, Atomic, and many angels.

Join our Telegram Group and follow our Twitter account to stay up to date and get notified when content is out!

See you on Thursday for Thursday Thoughts #12,

The Dove Team