Hello world, and welcome to Dove Mountain Weekly #8!

Today, we are digging into traditional funds investing in crypto companies.

In 2021 alone, Goldman Sachs participated in 3 crypto funding rounds (CoinMetrics, Axoni, Blockdaemon): a clear signal of traditional funds’ interest in the space.

Blockchain VCs invested less than $2.5B in 2020 — which represents 0.9% of the global VC market. But more than $2.7B was raised by crypto companies in Q1 alone, meaning that 2021 Q1 investments in the crypto space outperformed the entire 2020.

As more and more capital is flowing into the industry, to what extent are traditional VCs entering the crypto venture landscape?

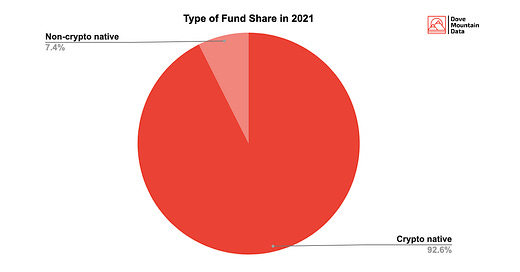

(We define crypto native funds as funds that exclusively invest in crypto companies)

Zooming in, 92.6% of funds participating in crypto fundraising deals in 2021 were crypto native. 73.1% of the non-crypto-focused funds actively investing are based in the United States, with Founders Fund, Kindred Ventures, Initialized and Tiger Global Management leading the pack.

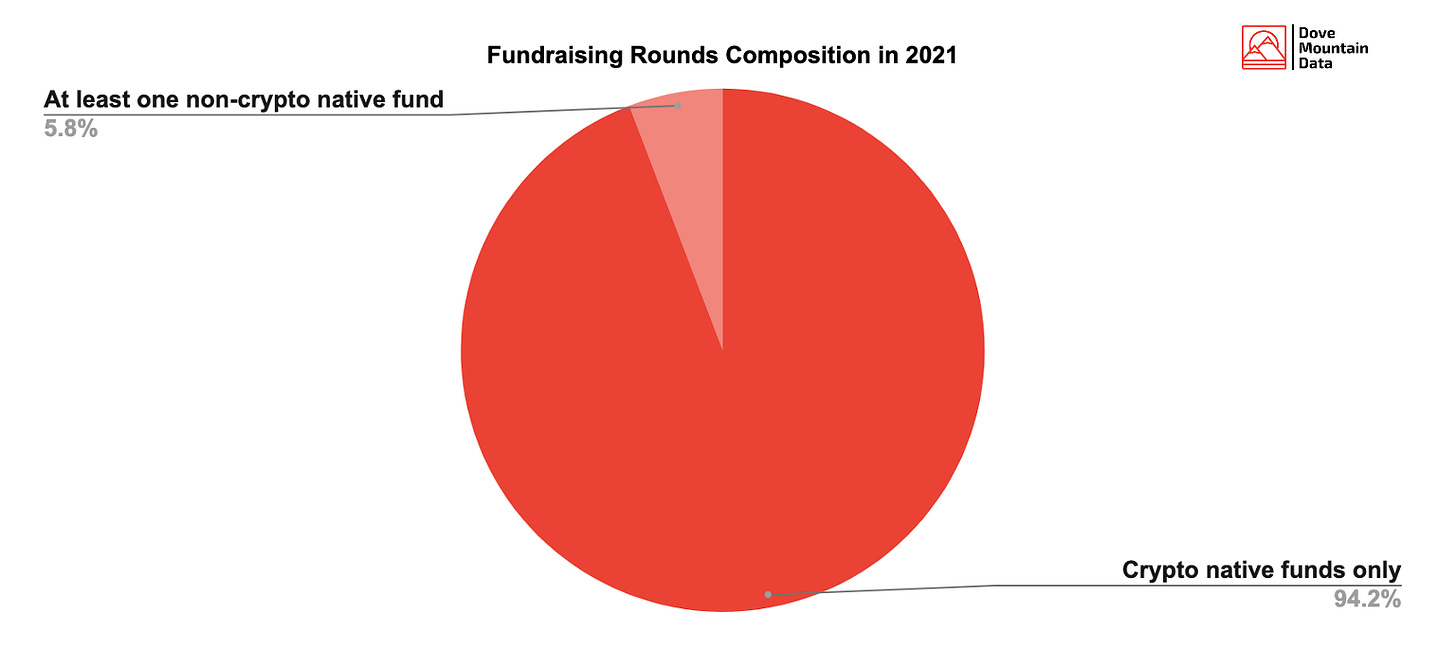

Looking at the crypto 2021 fundraising rounds, the exact same trend is confirmed: a large majority of the funding processes are completed with only crypto native funds.

When analyzing the most attractive verticals for traditional VCs, CeFi and Infrastructure stand out. Some of the recent noteworthy funding rounds are:

Chainanalysis ($100M) — with participation from Coatue Management, Benchmark, Accel, Addition, 9Yards Capital, Dragoneer Investment Group, Durable Capital Partners, Altimeter, Blackstone, GIC, Pictet Group, SVB Capital, Sequoia Heritage, and others.

Kaiko ($24M) — with participation from Anthemis, Underscore VC, Point Nine Capital, Alven, and others.

CipherTrace ($27.1M) — with participation from Third Point Ventures, Neotribe Ventures, Acrew Capital, Seraph Group, and others.

Tesseract ($25M) — with participation from Augmentum Fintech, BlackFin Capital Partners, Concentric, DN Capital, Jabre Capital Partners, Sapphire Ventures, Icebreaker.vc, and others.

Securitize ($48M) — with participation from Morgan Stanley, IDC Ventures, Sumitomo Mitsui Trust Bank (SMTB), Global Brain Corporation, Migration Capital, Mouro Capital, Ripio, and others.

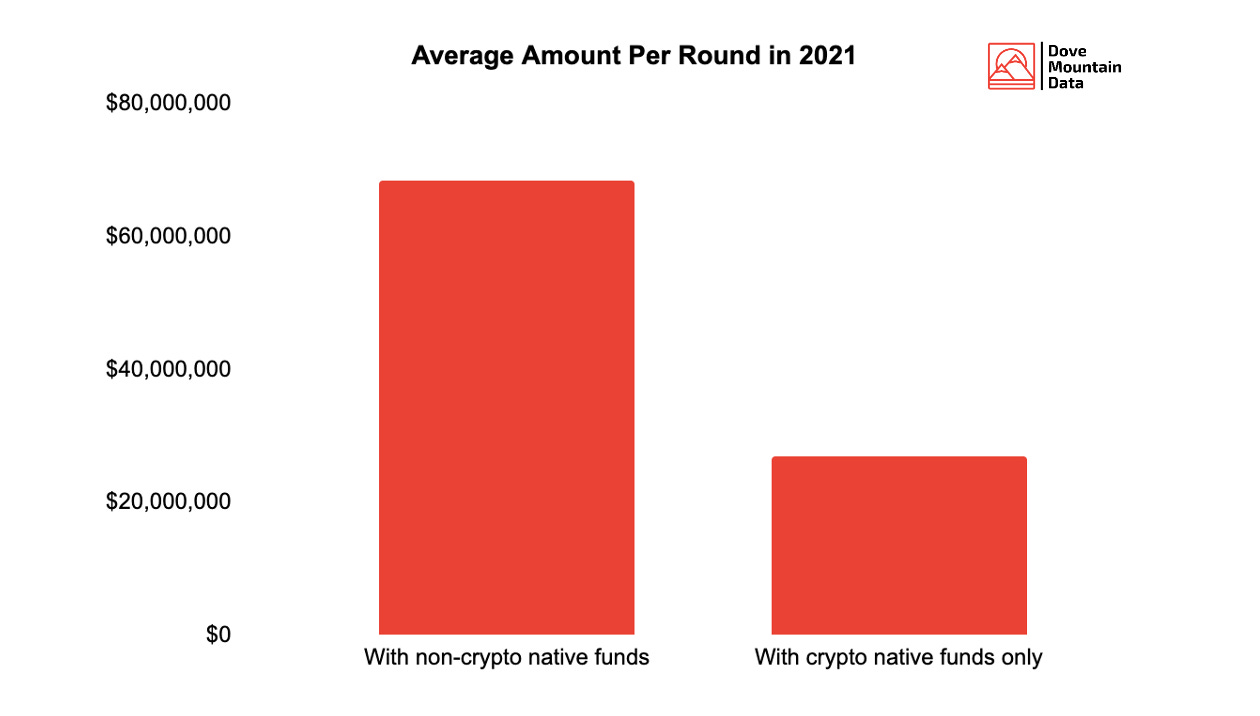

There is no doubt that non-crypto native funds are more likely to participate in late-stage fundraising rounds. The average amount raised by crypto companies is $68.5M when at least one traditional fund is involved — compared to $27M when participants are crypto-focused funds only.

The potential outsized returns are a key driver for traditional VCs to enter the space — even for equity deals. In 2020, blockchain private equity has outperformed traditional private equity across one, three, and five-year horizons.

But regulatory uncertainty, lack of knowledge, and reputational risk toward LPs still represent strong barriers to investments.

Feel free to have a look at Dove Mountain Data, the richest dataset ever publicly released on crypto fundraising rounds.

We have included last week’s 15 fundraising rounds:

Bling — with participation from Coinbase Ventures.

Syndicate ($800k) — with participation from Alex Masmej, Alana Podrx, Alexis Gauba, Ameer Suhayb Carter, Brian Flynn, Calvin Liu, Carlos Gomes, Christy Choi, Colleen Sullivan, Sebastian Delgado, Ryan Selkis, Robbie Bent, Ramon Recuero, Raj Gokal, Noah Jessop, Nathalie McGrath, Morgan Beller, Min Teo, Mildred Idada, Erik Syvertsen, Erikan Obotetukudo, Illia Polosukhin, Jake Chervinsky, James Foley, Jazear Brooks, Jeff Morris, Regan Bozman, and many others.

Community Gaming ($2.3M) — with participation from CoinFund, Dapper Labs, Animoca Brands, Multicoin Capital, and others.

2TM Group ($200M) — with participation from SoftBank.

Mintable ($13M) — with participation from Ripple, Metapurse, Animoca Brands, and Jon Oringer.

Animoca Brands ($50M)) — with participation from Coinbase Ventures, Gobi Partners, Liberty City Ventures, Token Bay Capital, Blue Pool Capital, Korea Investment Partners, and Scopely.

Calaxy ($7.5M) — with participation from Animoca Brands, Red Beard Ventures, ArkStream Capital, NGC Ventures, GBV Capital, Ezekiel Elliott, Matt James, Luke Walton, Jonathan Padilla, Larry Ogunjobi, and others.

Dexlab ($1.44M) — with participation from Parataxis Capital, GBV Capital, CMS Holdings, NGC Ventures, LedgerPrime, Bixin Ventures, Digital Finance Group, Sonic Capital, Evernew Capital, Genblock Capital, ROK Capital, Dragon Roark Venture, 499 Block, Cryptomeria Capital, Axia8 Ventures, Petrock Capital, and Momentum 6.

Valkyrie ($10M) — with participation from 10X Capital, UTXO Management, Precept Capital Management, Justin Sun, Charlie Lee, and others.

IAGON ($3.4M) — with participation from AU21 Capital, LedgerLink Labs, Blockchain Israel, Kirin Fund, and others.

AID:Tech ($3.5M) — with participation from Affinidi, Josue Estrada, Nakhla VC, and Richard Wang.

Tracer ($4.5M) — with participation from Framework Ventures, Digital Asset Capital Management, Maven11 Capital, Apollo Capital, Distributed Global, Paperclip Fund, Supernova Fund, Stani Kulechov, 0xMaki, Simon Cant, Joyce Yang, Juan David Mendieta, Ermin Nurovic, Sid Powell, TokenInsight, Danny Gilligan, Joe Flanagan, James Simpson, Radek Ostrowski, Kevin de Patoul, Henrik Andersson, and Ashwin Ramachandran.

Nansen ($12M) — with participation from Skyfall Ventures, Andreessen Horowitz, Coinbase Ventures, imToken Ventures, Mechanism Capital, QCP Capital, Fabric Ventures, Ana Andrianova, Will Price, Dovey Wan, Vincent Niu, Bitscale Capital, Jeremy Kerbal, Allen Day, Daryl Lau, Darren Lau, Kevin Hu, and Joel John.

Coinvise ($2.5M) — with participation from The LAO, Volt Capital, Reuben Bramanathan, Cooper Turley, Joyce Yang, IDEO Colab Ventures, Galaxy Digital, Scalar Capital, A.capital, DeFi Alliance, Free Company, Global Coin Research, Perpetual Value, Morgan Beller, Block0, Jill Carlson, Jaynti Kanani, Alex Masmej, Don Ho, Scott Moore, and Krishna Sriram.

We have also added the following investors: Paperclip Fund, Supernova Fund, Precept Capital Management, 10X Capital, UTXO Management, Poiesis Capital, Meld Ventures, Oyster Ventures, BIP32 Venture, RedBlock Capital, Superchain Capital, Quest Capital, CollinStar, MI.VC, Jackdaw Capital, Savy Capital Partners, ZB Labs, Scorpio VC, and many angels.

Join our Telegram Group and follow our Twitter account to stay up to date and get notified when content is out!

See you on Thursday for Thursday Thoughts #5,

The Dove Mountain Team