Hello world, and welcome to Dove Dispatch #19!

Today, we are digging into the world of venture investment DAOs.

Dove Metrics is sponsored by The Index Coop - a community-led initiative focused on making crypto investing simple, accessible, and safe. They create and maintain the world’s best crypto index products: DeFi Pulse Index ($DPI), ETH2x-Flexible Leverage Index (ETH2x-FLI), BTC2x-Flexible Leverage Index (BTC2x-FLI), Metaverse Index ($MVI), and Bankless BED Index ($BED).

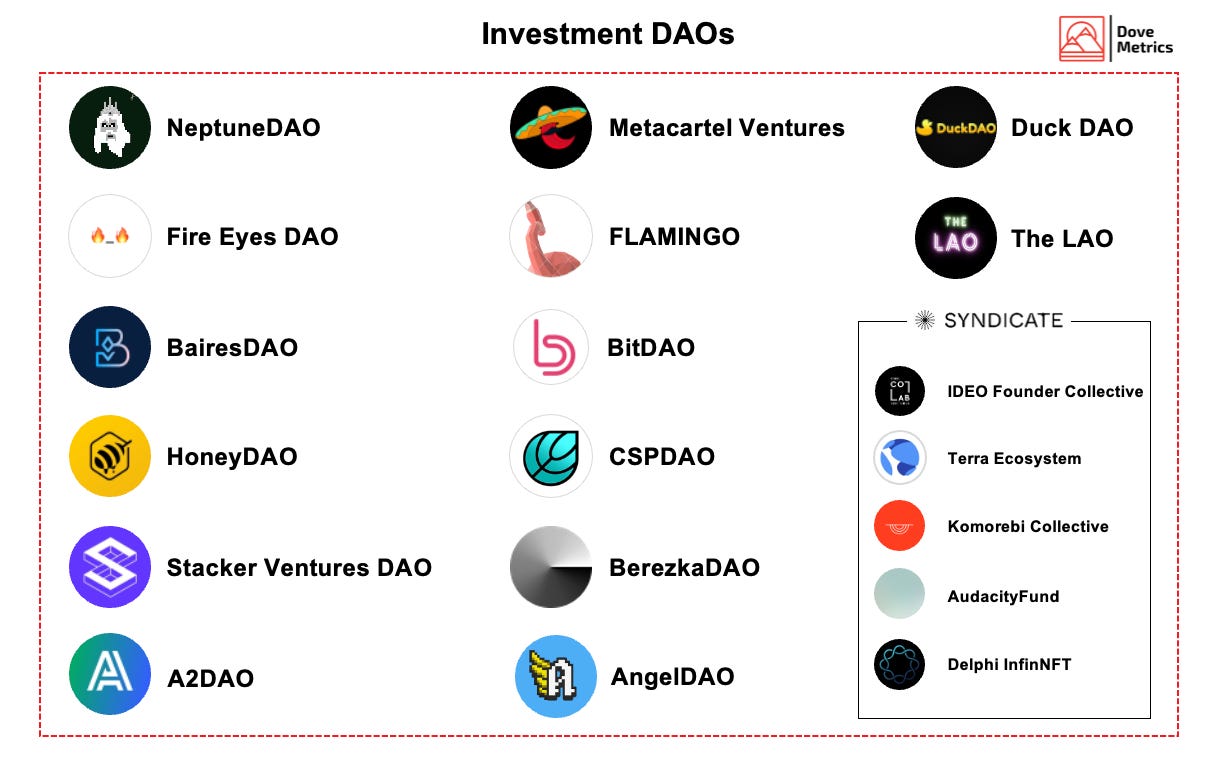

Last August, Tally titled its $6M fundraising round announcement “The Future is DAO”, and onboarded The LAO, MetaCartel Ventures, Baires DAO, and Fire Eyes DAO as investors. In other words, “that was DAOs funding the tools for more DAOs”.

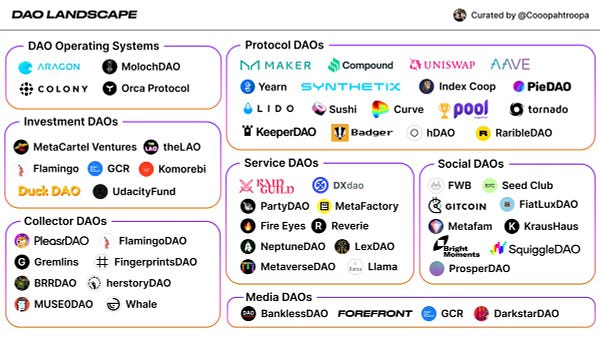

Vitalik Buterin coined the term DAO back in 2013, suggesting “to create an inviolable contract that generates revenue, pays people to perform some function, and finds hardware for itself to run on”. Eight years later, venture DAOs are so hot that they keep taking up a lot of space in the DAO landscape.

Venture investment DAOs are community-run protocols for managing pooled capital on the blockchain and taking collective decisions about investments.

Even if processes can be different from one DAO to another, each member can bring proposals to the DAO, which is upvoted by the contributors, rather than being subject to an investment committee. Some DAOs can have a shorter timespan (sometimes 1 year) they justify by outlining the lightning-fast pace of the industry.

Across all the investment DAOs we identified, 348 investments have been made since they launched. The most active ones in 2021 are CSP DAO, DuckDAO, The LAO, and Metacartel Ventures. On average, an investment DAO has made 25 deals in its existence.

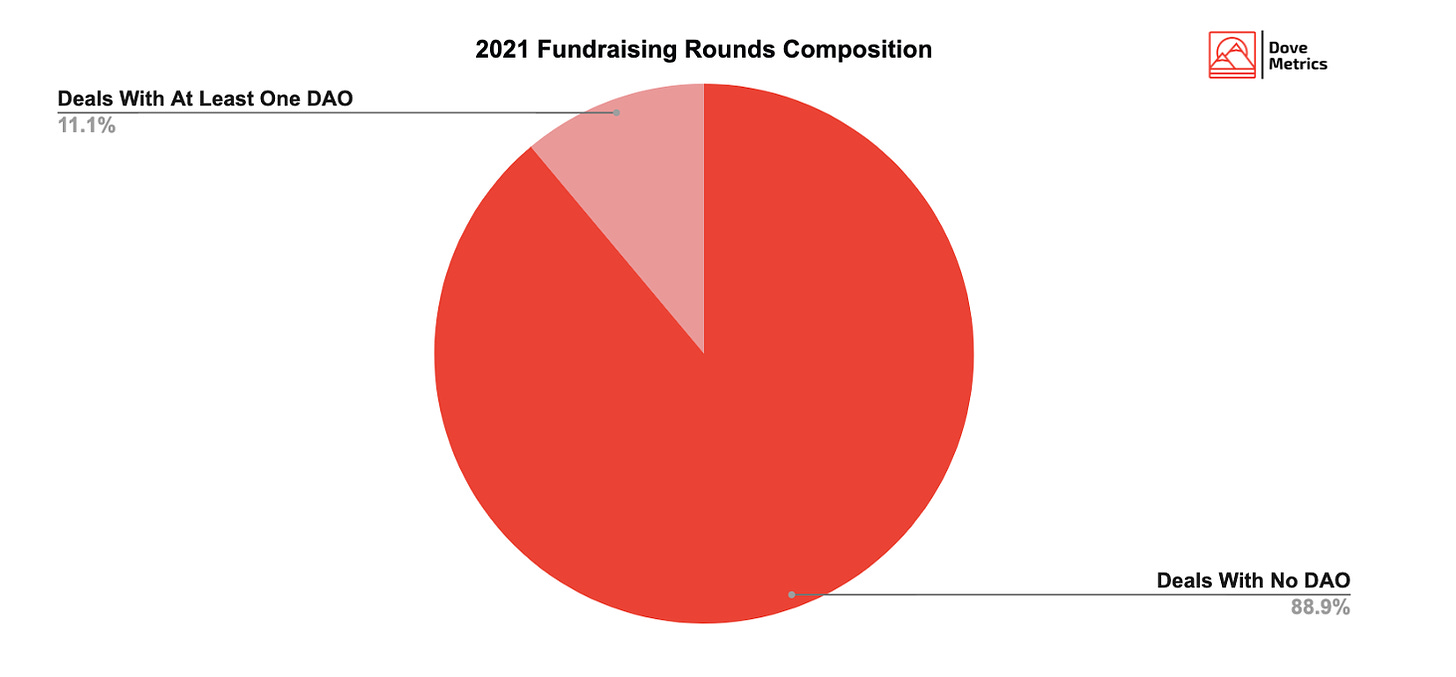

94 fundraises announced in 2021 were completed with the participation of at least one investment DAO, for a total of $584M raised, compared to $15.9B of fresh capital deployed to crypto ventures in 2021.

Some noteworthy rounds even include more than only one DAO:

Seed Club ($2M) — with participation from The LAO and Metacartel Ventures.

Superfluid ($9M) — with participation from The LAO, Metcartel Ventures, and Angel DAO.

Opolis ($4.75M) — with participation from Metcartel Ventures and Angel DAO.

Friends With Benefits ($750k) — with participation from The LAO and Metacartel Ventures.

A large majority of the 2021 funding processes have been completed without any DAO, even though they do represent a decent proportion of the non-crypto native entities injecting capital into crypto ventures. In comparison, 1.3% of the fundraise comprises one or more banking groups only.

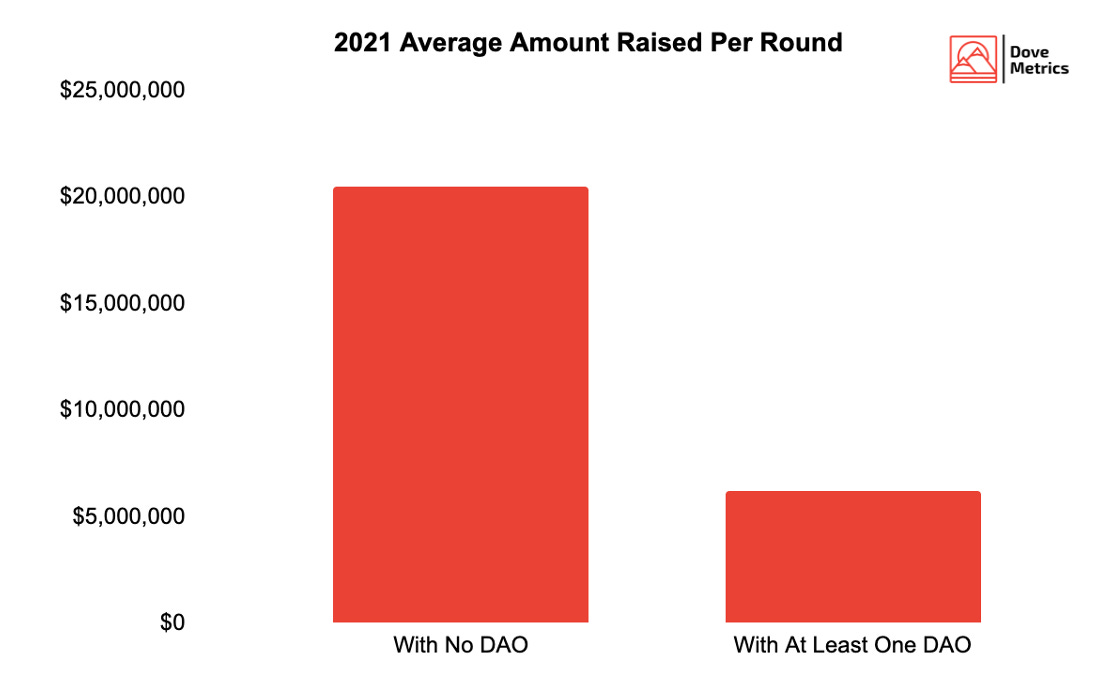

Unsurprisingly, the average amount raised by crypto companies is $6.2M when at least one investment DAO is involved — compared to $20.5M when there is no DAO.

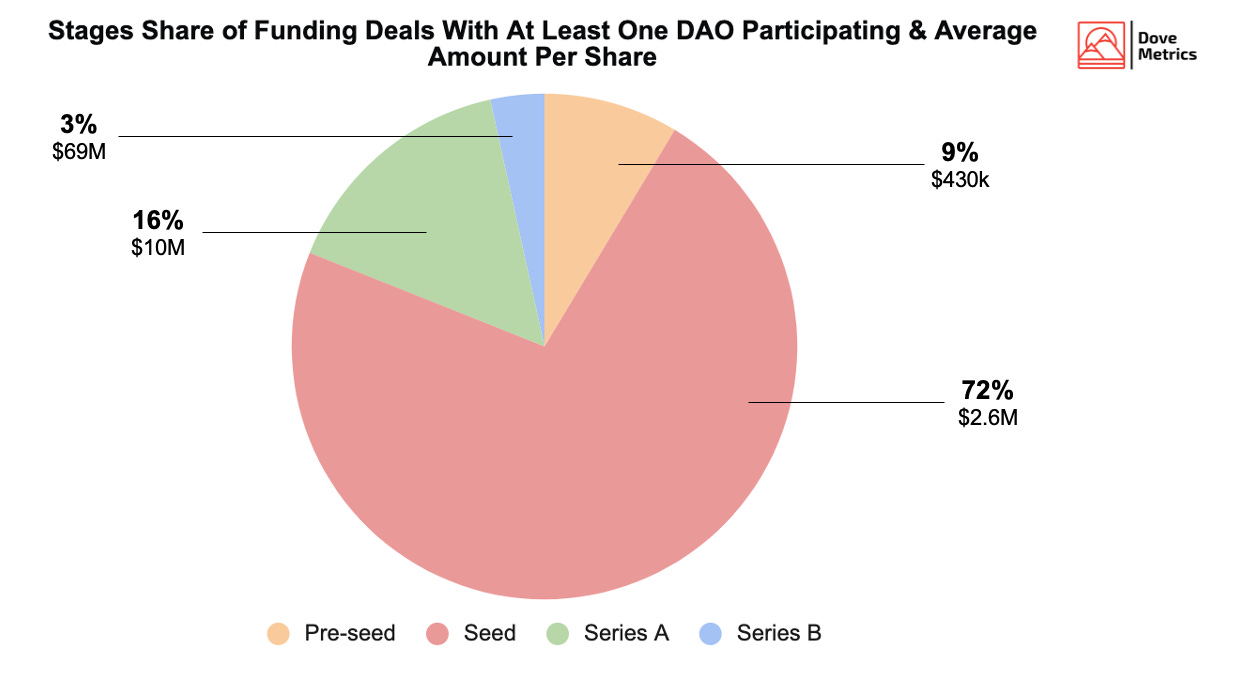

Again, data makes it clear: pre-seed and seed funding account for more than 81% of the announced raises, while none of the actively investing DAOs have participated in rounds later than Series B.

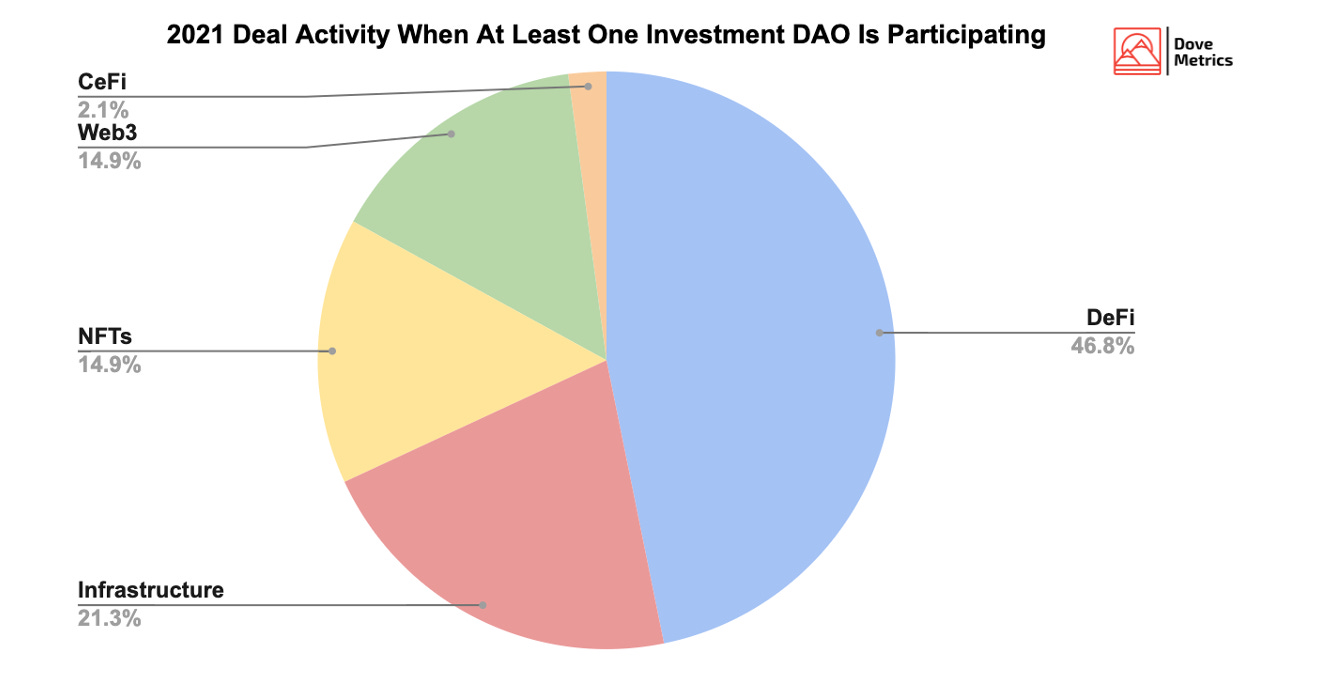

With 46.8% of the deals, DeFi has undoubtedly been investment DAOs sweet spot so far. Besides overall hype about DeFi in the crypto venture ecosystem, this is mostly explained by the fact that some investment DAOs offer additional services to their members by supplying capital to some DeFi lending protocols and DEXes, like BerezkaDAO, which also invested in Panther Protocol.

Such a strategy aims at receiving fees as well as yield farming tokens which can be redistributed to contributors. Similarly, Stacker Ventures oversees a series of yield funds focused on generating competitive APY by investing pooled funds in whitelisted strategies.

Because the value added by investment DAOs to projects they invest in has been pointed out by some prominent DeFi leaders, interesting initiatives are emerging:

Incubation: DuckDAO describes itself as the first-ever community-driven crypto incubator, and helps projects with marketing, listing processes, and social media strategy. A similar track called Community Accelerator has been implemented by Stacker Ventures.

Audit: A2DAO provides high-level audit by community members.

Tokenomics and governance systems: Fire Eyes DAO has originally been launched to contribute to a suite of governance launches.

Some others, like HoneyDAO, offer a wide range of support by tackling community management, beta testing, partnership expansion, and content management.

Even if smart contract risks and sometimes unclear regulation can tarnish the future of investment DAOs, they should keep gaining momentum and continue proliferating:

Syndicate Protocol and Coinocracy Finance — DAO service providers developing frameworks and offers (off-chain legal entity formation, on-chain smart contract, administrative services) to make access to investment DAOs cheaper and easier.

Treasury Diversification deals — The LAO and Metcartel Ventures have been active investors in projects diversifying their treasury, and DAO-to-DAO venture deals should get more common over the next few months.

New models based on token incentive mechanisms — DAOs like DuckDAO, CSP DAO, and Stacker Ventures introduced liquid tokens anyone can purchase on the open market, and built ranking systems within the DAO.

Tribute DAO — the latest smart contract version OpenLaw has built, which aims at solving Moloch v2 issues (flexible voting module, improved modular architecture, multiple token DAO structures, and NFT support).

Moloch v3 — currently in development, it should bring better infrastructure thanks to features such as enabling DAOs to buy out member shares and allowing alternative vote tabulation mechanisms.

Some upcoming investment DAOs — FTW.DAO, a diversity-focused DAO is about to launch, and in Japan, Fracton Ventures plans to involve corporate investors in venture DAOs.

Last week 21 projects announced fundraising rounds:

Authena ($2.4M) | An IoT and Blockchain platform used for traceability and authenticity protection of brands — with participation from Ecliptic Capital.

Kollect ($2M) | The gamified collection card universe powered by NFT — with participation from OKEX, FBG Capital, Infinity Ventures Crypto, Soul Capital, Kenetic, a41 Ventures, TK Ventures, Grenade Lab, ICO Pantera, Kyros Ventures, CryptoKudasaiJP, Avstar Capital, Bitcoin Addict Thailand, Vendetta Capital, Sunrise Dragon, and CatcherVC.

Forefront ($2.1M) | The port of entry to social clubs and digital cities — with participation from 1kx, Scalar Capital, Divergence Ventures, MetaCartel Ventures, Own Fund Collective, DeFi Collective, Jenil Thakker, Andy Chen, Kevin Chou, Patrick Rivera, Ian Lee, Will Papper, Brett Shear, Trevor McFedries, Samantha Yap, Anthony Sassano, James Waugh, and Jesse Grushack.

LayerZero ($6.3M) | An omnichain interoperability protocol that unites decentralized applications across disparate blockchains — with participation from Binance Labs, Multicoin Capital, SinoGlobal Capital, DeFiance Capital, Delphi Digital, Robot Ventures, Spartan Group, Hypersphere Ventures, Protocol Ventures, Genblock Capital, and Echelon Capital.

Avalanche Foundation ($230M) | The fastest smart contracts platform in the blockchain industry, as measured by time-to-finality — with participation from Three Arrows Capital, Polychain Capital, Dragonfly Capital, CMS Holdings, Collab+Currency, Lvna Capital, and Republic.

Minterest ($6.5M) | A ground-breaking lending protocol built by industry leaders to service billions in TVL and to challenge existing DeFi incumbents — with participation from KR1, DFG (Dynamic Fintech Group), CMS Holdings, FOMOCraft Ventures, Bitscale Capital, PNYX Ventures, CMT Digital, Faculty Capital, and Digital Strategies.

MonoX ($5M) | Single token pools for maximum capital efficiency and impermanent loss protection — with participation from Axia8 Ventures, Animoca Brands, and Divergence Ventures.

Starpunk Metaverse ($1.8M) | All-in-one launch base to incubate and accelerate NFT gaming startups into the market — with participation from DAO Maker, UG Ventures, Megala Ventures, Everse Capital, Gate.io, Wings Ventures, Kyros Ventures, Trade Coin Vietnam, Raptor Capital, Magnus Capital, Crypto Viet Labs, Infinity Capital, Crypto Checker, MCG Capital, Blue Node Capital, CoinF, Metrix Capital, CinchBlock, TK Ventures, OnBlock Ventures, Nabais Capital, and X21 Digital.

Coinfirm ($8M) | Leading the industry in compliance for cryptocurrency, using powerful analytics across the most comprehensive blockchain database— with participation from SIX FinTech Ventures, Middlegame Ventures, Mission Gate, and Avaloq.

PrimeDAO ($2M) | Building tools that turn DeFi into a cooperative ecosystem - DAO2DAO products and services — with participation from LD Capital, Stratos Technologies, TokenInsight, Stacker Ventures, Signum Capital, Atka Capital, ID Theory, SMAPE Capital, XeO4, Meld Ventures, Faculty Group, Senary Ventures, Fernando Martinelli, Griff Green, and NiMA Asghari.

Abra ($55M) | A digital wallet that supports bitcoin and over 50 fiat currencies — with participation from Ignia, Blockchain Capital, Kingsway Capital, CMT Digital, Tiga Investments, Stellar Development Foundation, RRE Ventures, Lerer Hippeau, Kenetic, Arbor Ventures, and American Express Ventures.

Stardust ($5M) | Software platform empowering video games with crypto functionality & security — with participation from Lattice Capital, Framework Ventures, Kleiner Perkins, Blockchain Capital, Distributed Global, Maven 11 Capital, Red Beard Ventures, Double Peak, NGC Ventures, OP Crypto, Triblock, Dan Rubin, Derek Hsue, Pim de Witte, Sébastien Borget, Gabby Dizon, Piers Kicks, Multicoin Capital, CMT Digital, Fulgur Ventures, and Nikil Viswanathan.

Domination Finance ($3.2M) | The world’s first DEX for dominance trading - built on UMA Protocol — with participation from ParaFi Capital, Dragonfly Capital, AU21 Capital, Shima Capital, LD Capital, Huobi Capital, OKEX, KNS Group, GSR, CoinGecko Ventures, OP Crypto, Hart Lambur, Sandeep Nailwal, JP Richardson, Ayesha Kiani, Min H. Kim, and David Wachsman.

Floating Point Group ($10M) | FPG is a platform to trade, manage, and settle cryptocurrency assets in a faster and more secure manner — with participation from Tribe Capital, Nitesh Banta, Formula Ventures, Coinbase Ventures, Borderless Capital, Anthony Scaramucci, CapitalX, and FAST.

Immutable ($60M) | The first layer 2 for NFTs on Ethereum - zero gas fees, instant trades & up to 9k TPS — with participation from AirTree Ventures, Alameda Research, Apex Capital Partners, Fabric Ventures, BITKRAFT Ventures, Galaxy Interactive, King River Capital, Reinventure, VaynerFund, and Prosus Ventures.

dTrade ($22.8M) | Decentralised perpetuals and options trading built on Polkadot — with participation from Hypersphere Ventures, Polychain Capital, DeFiance Capital, Alameda Research, CMS Holdings, Divergence Ventures, Mgnr, Altonomy, Ricky Li, and Calvin Liu.

Amberdata ($15M) | The most comprehensive institutional grade on-chain data, market data, metrics, and signals — with participation from Citi, Galaxy Digital, Franklin Templeton Investments, Rovida Kruptos Assets, and HWVP.

Matterless Studios ($1.25M) | Creating AI companions for the metaverse — with participation from Outlier Ventures, Cadenza Ventures, Kenetic, NGC Ventures, and ArkStream Capital.

FUFU ($1.7M) | NFT distribution through interactive PlayToEarn quizzes, bringing communities together creating a new form of content marketing — with participation from GBV Capital, Faculty Group, Boxmining, Morningstar Ventures, Impossible Finance, X21 Digital, 4SV, and Black Edge Capital.

Apollo DAO ($2.2M) | Yield management platform, built by DeFi users for DeFi users, on Terra — with participation from Pantera Capital, Do Kwon, GSR, PNYX Ventures, SkyVision Capital, Taureon Capital, Yunt Capital, Sneaky Ventures, 6K Starter, Global Coin Research, Nick Flammel, Luna Fastlaner, and Wolf of DeFi.

Colendi ($30M) | A comprehensive decentralized credit scoring protocol and microcredit platform with blockchain and machine learning technologies — with participation from Re-Pie Asset Management.

We have also added the following investors: AirTree Ventures, Atka Capital, SMAPE Capital, TK Ventures, and many angels.

Join our Telegram Group and follow our Twitter account to stay up to date and get notified when content is out!

See you on Thursday for Thursday Thoughts #14,

The Dove Team