Dove Dispatch #28 - Ethereum Scaling Solutions

Scaling Ethereum Also Requires Fresh Capital

GM and welcome to Dove Dispatch #28!

Today, we are digging into the fundraising ecosystem for Ethereum scaling solutions.

Dove Metrics is sponsored by BarnBridge - a protocol for tokenized risk, that enables users to calibrate their exposure to different risk vectors within DeFi. Its SMART Alpha application gives you more control over exposure to the performance of digital assets.

📹 Watch What is SMART Alpha?

StarkWare, an Ethereum Layer 2 developer using ZK Rollups technology, recently raised $50M, with participation from world-class VC firms such as Sequoia Capital, Paradigm, Three Arrows Capital, Alameda Research, and Founders Fund. This new funding round comes only seven months after the team announced a $75M Series B round.

Ethereum layer 2 scaling solutions are now regarded as vital for addressing the problems with current network performance. Diverse solutions are being tested and implemented, with different approaches for achieving scalability.

Some very well known scaling solutions-focused companies raised Seed funding rounds as early as 2019, such as Offchain Labs, which raised $3.7M from Pantera Capital, Coinbase Ventures, and others, to build “a combination of scalability so that you can scale to more transactions per second, more users, and to contracts that have more code and still have more data in them.”

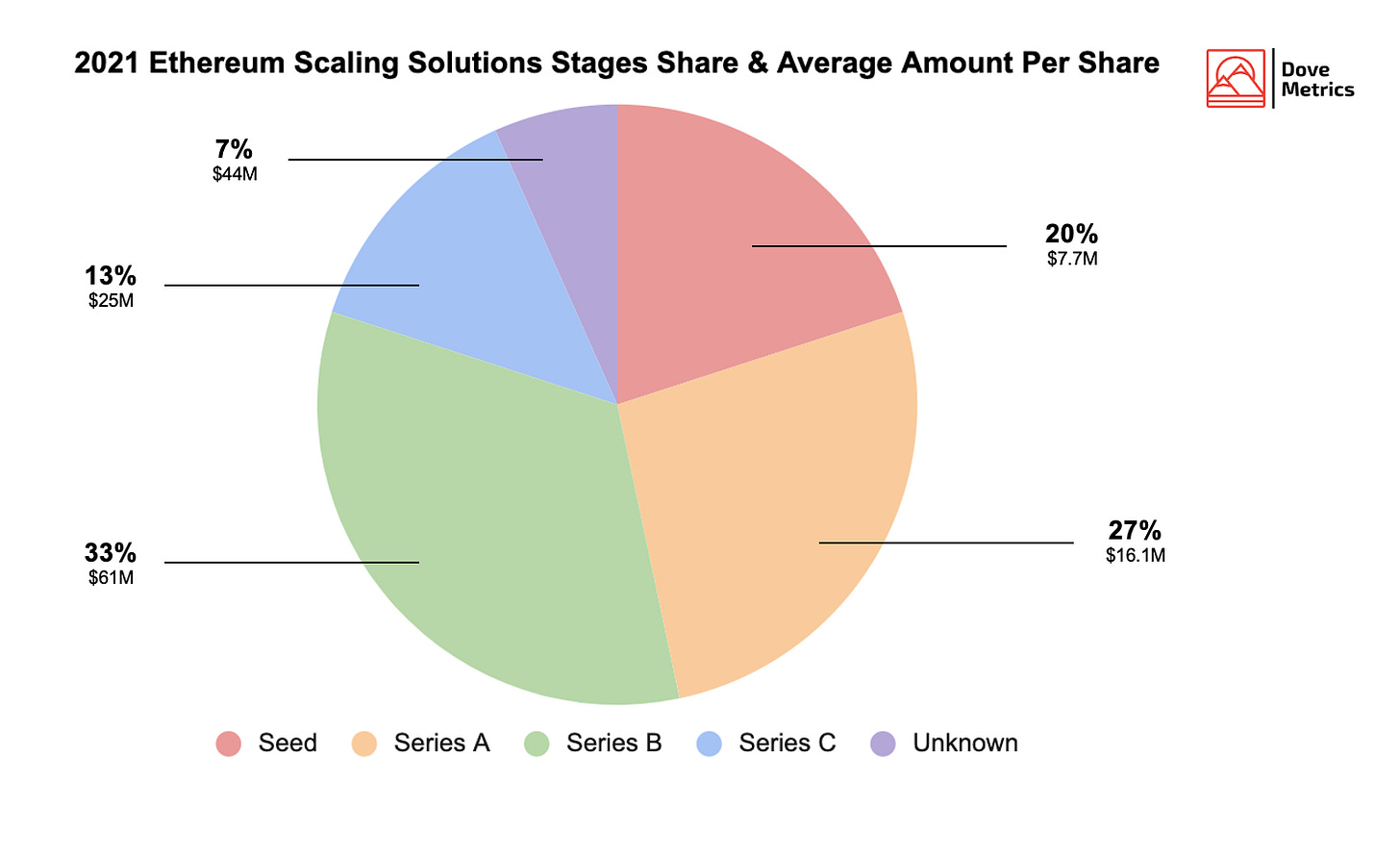

But 2021 has undoubtedly been the most hectic year for the Ethereum scaling solutions capital market, with 15 deals and $439.9M raised to date. As a comparison, it represents more than ten times the total amount of capital injected in similar solutions in 2019 and 2020 combined.

Scalability solutions concentrate around 8% of the fresh capital flowing into the infrastructure vertical in 2021 and 2% of what has been injected into the crypto industry overall.

$205M was raised in Q3 alone, 68% more than in Q1 and Q2 combined. Some noteworthy rounds:

Offchain Labs ($120M) — with participation from Redpoint, Ribbit Capital, Polychain Capital, Pantera Capital, Mark Cuban, Lightspeed Venture Partners, and Alameda Research.

Immutable ($60M) — with participation from AirTree Ventures, Alameda

Research, Apex Capital Partners, Fabric Ventures, BITKRAFT Ventures, Galaxy Interactive, King River Capital, Reinventure, VaynerFund, and Prosus Ventures.Connext ($12M) — with participation from eGirl Capital, Ethereal Ventures, Coinbase Ventures, MetaCartel Ventures, Scalar Capital, 1kx, ConsenSys Ventures, Sandeep Nailwal, Kenetic, Hashed, A.capital, and others.

Despite being composed of few projects, the fundraising ecosystem of Ethereum scaling solutions is getting relatively mature: 20% of the rounds only are earlier than Series A, and on average, $29M is raised by a company building in the space in 2021.

🙌 Thanks to our sponsors at BarnBridge

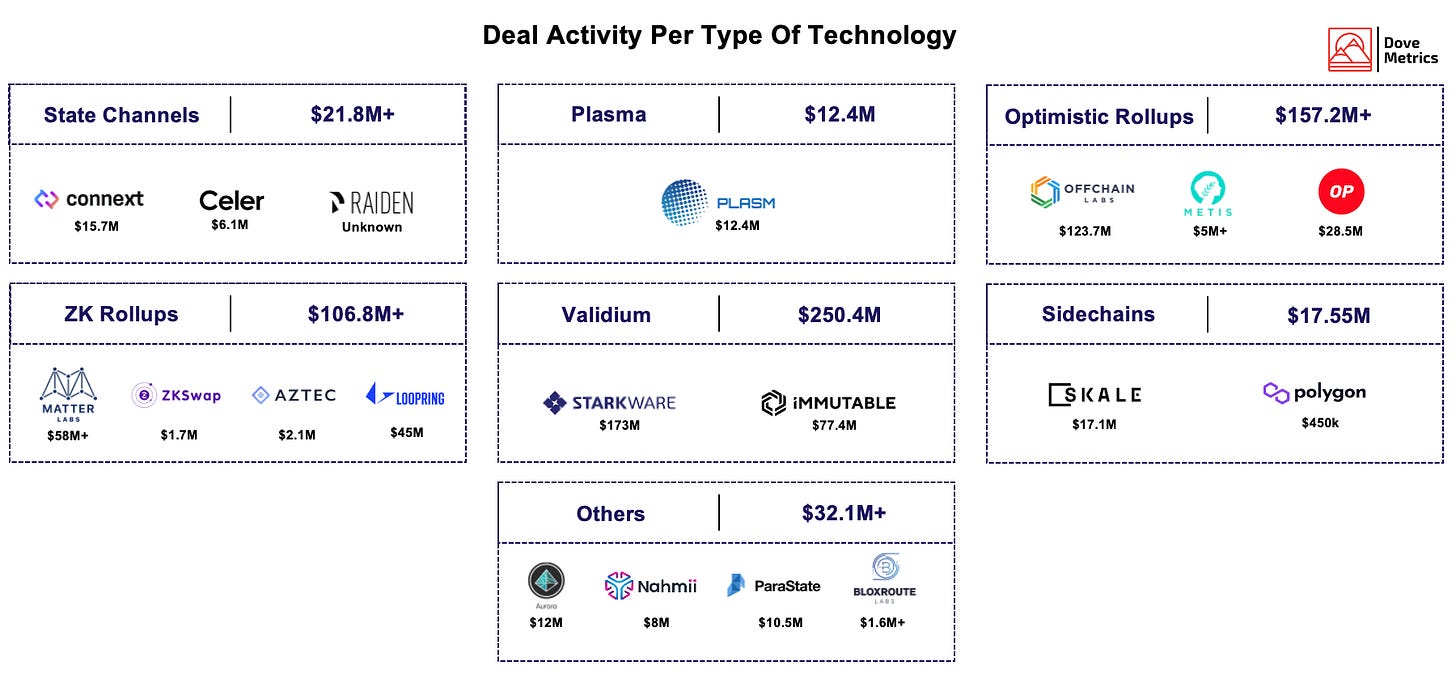

Over the last few years, several types of solutions have emerged to address the challenges Ethereum has been facing.

As put by the Euthereum Foundation itself, “no one scaling solution is enough to fulfill the eth2 vision, and multiple solutions can help reduce the overall congestion on any one part of the network, and also prevents single points of failure”.

Zooming in, rollups seem to represent an attractive technology for investors with more than $106.8M raised by companies built on ZK Rollups and $157.2M for projects focused on Optimistic Rollups.

Validium, which uses validity proofs (like a ZK Rollup) without keeping the data on the Ethereum chain, has also attracted a large amount of capital, with more than $250M raised.

Last week 29 projects announced fundraising rounds:

Cypher ($2.1M) | A decentralized synthetic asset protocol, allowing retail and institutional investors to create and trade pre-public markets — with participation from Blockwall, SinoGlobal Capital, SkyVision Capital, ROK Capital, Mgnr, a41 Ventures, Serum, Alphanonce, Darkpool Liquidity, Gerstenbrot Capital, and AGE Crypto.

DoraHacks ($8M) | Explore the world of innovation at HackerLink, BUIDL, continuous funding, grant, bounty, and hackathons — with participation from Binance Labs.

Snapshot Labs ($4M) | A decentralized organization governance solution provider — with participation from 1kx, Coinbase Ventures, StarkWare, MetaCartel Ventures, Gnosis, Scalar Capital, The LAO, Boost VC, Fire Eyes DAO, LongHash Ventures, and Cooperative Kleros.

SportsIcon ($5.5M) | Athlete curated insights into pivotal moments of their journey through immersive, artistic, inspirational NFTs, unlockable content and community — with participation from Techstars, Fish DAO, Vendetta Capital, Diverse Angels, Dapper Labs, Elefund, Sound Media Ventures, AU21 Capital, Fourth Revolution Capital, Angel Invest Ventures, Vinny Lingham, Sunny Madra, and Craig Clemens.

Gemini ($400M) | A next-generation cryptocurrency exchange and custodian that allows customers to buy, sell, store and earn digital assets — with participation from Morgan Creek Digital, 10T Fund, ParaFi Capital, Newflow Partners, Marcy Venture Partners, Commonwealth Bank of Australia, Boost VC, VanEck, WndrCo, K5 Global, Jane Street Capital, Pantera Capital, and UTA Ventures.

Kibo Finance ($1.5M) | First borderless options trading protocol — with participation from Republic, Fenbushi Capital, AU21 Capital, Huobi Capital, Genblock Capital, DFG, Kenetic, GSR, Mgnr, Gate.io, LedgerPrime, Bitcoin.com, Borderless Capital, Cosimo Ventures, Shima Capital, OP Crypto, Jsquare, LinkPad VC, Sandeep Nailwal, and Mirza Uddin.

BlockchainSpace ($3.75M) | Enabling play-to-earn guilds to scale in the Metaverse — with participation from Animoca Brands, Spartan Group, Infinity Ventures Crypto, 3Commas, Arca, Bitscale Capital, CMS Holdings, CoinGecko Ventures, Fenbushi Capital, GBV Capital, Mechanism Capital, Parataxis Capital, Petrock Capital, Sfermion, Stable Node, Yield Guild Games, Aleksander Larsen, Jeff Zirlin, Gabby Dizon, Sébastien Borget, and Colin Goltra.

BetDEX ($21M) | The global decentralized sports betting protocol — with participation from Paradigm, FTX, Multicoin Capital, Hack VC, Lightspeed Venture Partners, SinoGlobal Capital, Solana Capital, and Everblue Management.

Mem Protocol ($3.1M) | Building human-centric tools for web3 social. Own your friend graph, explore the blockchain and earn by sharing knowledge — with participation from Andreessen Horowitz, Morgan Beller, Jon Kol, Balaji Srinivasan, Jude Gomila, Olaf Carlson-Wee, Charlie Cheever, and Charlie Songhurst.

Anoma Network ($26M) | A proof-of-stake blockchain that allows traders to conduct private, asset-agnostic transactions — with participation from Polychain Capital, Electric Capital, Zola Global Investors, Maven 11 Capital, Fifth Era, and CMCC Global.

Nym Technologies ($13M) | An open-ended anonymous overlay network that works to irreversibly disguise patterns in Internet traffic — with participation from Andreessen Horowitz, Digital Currency Group, Fenbushi Capital, Hashkey Capital, Huobi Capital, and Tayssir Capital.

ConsenSys ($200M) | A blockchain software technology company focused on the Ethereum ecosystem — with participation from HSBC, Third Point Ventures, Marshall Wace, ParaFi Capital, Think Investments, Dragonfly Capital, Electric Capital, Spartan Group, DeFiance Capital, Animoca Brands, and Coinbase Ventures.

Arrow Markets ($1.4M) | Efficient options AMM and decentralized settlement system built on Avalanche — with participation from Alameda Research, Avalanche Foundation, CMS Holdings, Delphi Digital, Framework Ventures, RenGen.io, QCP Soteria, and DeFi Capital.

Iconicchain ($1.2M) | Compliance based on facts, not faith — with participation from OXO Technologies Holding.

Nftfi ($5M) | A simple marketplace for NFT collateralized loans. Put your NFTs up as collateral for a loan, or offer loans to other users — with participation from Sound Ventures, Reciprocal Ventures, Scalar Capital, SkyVision Capital, A.capital, Fenbushi Capital, Kleiner Perkins, Galaxy Digital, Brevan Howard Asset Management, LongHash Ventures, and Jimmy McNelis.

Kosen Labs ($5M) | Bringing the best minds in AI/ML and blockchain development together, to tackle the hardest problems in web3 — with participation from Andreessen Horowitz, Framework Ventures, Protocol Labs, Daedalus Angel Syndicate, Formless Capital, Mona El Isa, Santiago R. Santos, Rune Bentien, Han Hua, and Liquidity Wizard.

pSTAKE ($10M) | Unlocking liquidity for staked assets — with participation from Three Arrows Capital, Sequoia Capital, Galaxy Digital, DeFiance Capital, Coinbase Ventures, Kraken, Spartan Group, Alameda Research, SinoGlobal Capital, Tendermint Ventures, Lattice Capital, Ajit Tripathi, Do Kwon, Tascha Punyaneramitdee, and Darren Lau.

Wonder ($2.5M) | Launch and scale your projects with the power of Web3 — with participation from Chapter One, Village Global, Slow Ventures, Spartan Group, Sneaky Ventures, FJ Labs, Basecamp Fund, Lattice Capital, Tess Hau, Dapper Labs, Sisyphus, Jason Choi, Brian Flynn, Andy Artz, Richard Dai, Chris Quinn, Kipp Bodnar, and Eric Scott.

StarkWare ($50M) | Scalability solution relying on cryptographic proofs produced by an off-chain prover running in the cloud and then verified by an on-chain smart contract — with participation from Sequoia Capital, Paradigm, Three Arrows Capital, Alameda Research, and Founders Fund.

Gallery ($2.69M) | The next platform for self-expression on the internet — one based on the things we collect and own — with participation from Collab+Currency, Distributed Global, Lattice Capital, Palm Tree Crew, Galaxy Interactive, FlamingoDAO, Scalar Capital, The LAO, Coinbase Ventures, Dapper Labs, Santiago R. Santos, Cooper Turley, Gabby Dizon, Deeze, Greg Isenberg, pplpleasr, Jamis Johnson, Trevor McFedries, Andy Chorlian, Dandelion, Seth Goldstein, and Jess Sloss.

CyberConnect ($10M) | Connect everyone on Web3. Building the social graph infrastructure for Web3 — with participation from Multicoin Capital, Sky9 Capital, Animoca Brands, Draper Dragon, Hashed, Zoo Capital, Smrti Lab, Mask Network, Lattice Capital, UpHonest Capital, and INCE Capital.

Ape Board ($1.2M) | A decentralized finance (DeFi) sector via crypto-asset aggregator and portfolio dashboard — with participation from Spartan Group, SCB 10X, DeFiance Capital, and LongHash Ventures.

Real Realm ($1.2M) | A blockchain-based war strategy game — with participation from AU21 Capital, CoinLab, Traveler Capital, X21 Digital, Lotus Capital, Dreamboat Capital, Alpha Moon Capital, Onebit Ventures, Wildcat Venture, Kylin Ventures, Bic Capital, Basics Capital, Token Suite, TheCodes Fund, IDOResearch Ventures, VNDC, BFRI Capital, and BSCStation.

Guardian Link ($12M) | Building tech infrastructure to help NFT commerce go mainstream — with participation from Kalaari Capital.

Polysynth ($1.5M) | An open, decentralised and cross-chain platform for leveraged long or short perpetuals and advanced crypto-financial products — with participation from Jump Capital, DeFi Alliance, Hashed, SMAPE Capital, Alan Howard, Sandeep Nailwal, Jaynti Kanani, Sanket Shah, Rahul Dalmia, and Joel John.

Irreverent Labs ($5M) | Creating artificially intelligent hundred-year entertainment experiences on the blockchain — with participation from Andreessen Horowitz, Mantis VC, Unlock Venture Partners, Advancit Capital, and KeenCrypto.

ALEX ($5.8M) | Bring your Bitcoin to Life: launch new projects, earn interest, rewrite finance, reinvent culture — with participation from White Star Capital, Cultur3 Capital, GBIC (Global Blockchain Innovative Capital), and OKEX.

Pawnfi ($3M) | Decentralized liquidity protocol for non-standard assets — with participation from Digital Currency Group, Animoca Brands, Dapper Labs, Polygon, DeFi Alliance, Hashkey Capital, Everest Ventures, SNZ Holding, and 6Block.

CiSApp ($174k) | World's first authentic reward-based social media platform built on blockchain — with participation from Seed Round Capital, and MicroVentures.

Dove Metrics newsletter is sponsored by BarnBridge.

BarnBridge’s SMART Alpha application was recently launched on mainnet as well as on Polygon and Avalanche. It allows users to get leverage or absolute downside protection on the asset performance. SMART Alpha achieves this by redistributing the assets of one side to the other. Seniors give assets to juniors when price performance is positive, and vice versa when price performance is negative.

📹 Watch What is SMART Alpha?

👀 Read Messari report on SMART Alpha

🕹 Play with SMART Alpha