Hello world, and welcome to Dove Dispatch #12!

We recently published our H1 2021 Crypto Fundraising Report. Go check it out!

Today, we are digging into the fundraising ecosystem for Metaverse-focused projects. The Metaverse is “a persistent, live digital universe that affords individuals a sense of agency, social presence, and shared spatial awareness, along with the ability to participate in an extensive virtual economy”. For the sake of clarity, we are excluding “entirely unstructured” Metaverse projects — apps like Cryptokitties which create avatars but don’t build a virtual world around them.

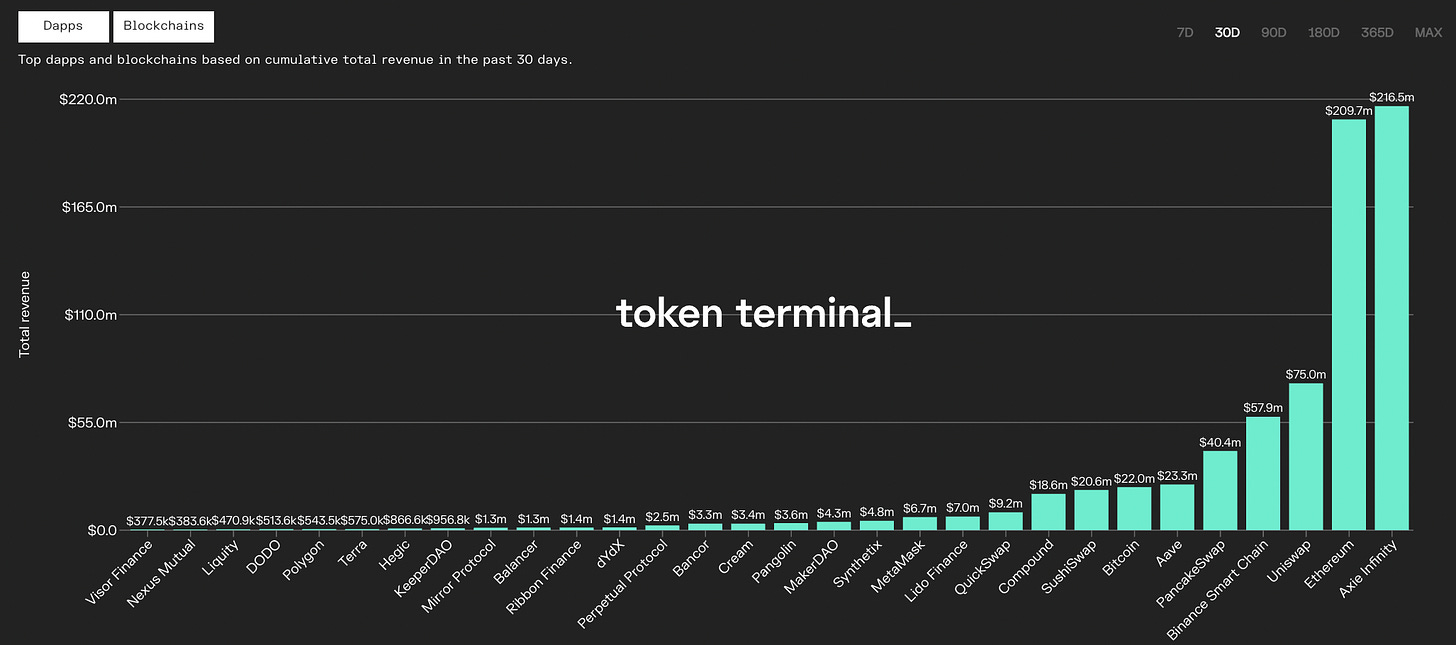

Axie Infinity collected over $216M in fees in the last month — 13x the previous month, and more than the next 11 top-ranking dApps (Uniswap, PancakeSwap, Aave, SushiSwap, Compound, QuickSwap, Lido Finance, MetaMask, Synthetix, and MakerDAO) combined.

Investing in the Metaverse is not new - in 2018, Digital Currency Group introduced Metaverse Ventures. Metaverse Ventures invests exclusively in companies building products and services for Decentraland — a decentralized 3D virtual reality platform where anyone can create a for-profit business.

Artie, one of Metaverse Ventures’ first investments, is a major 2021 Metaverse-related fundraising round, with $10M raised, with participation from Winklevoss Capital, Warner Music Group, Sinai Ventures, Shrug Capital, Raised in Space Enterprises, and others.

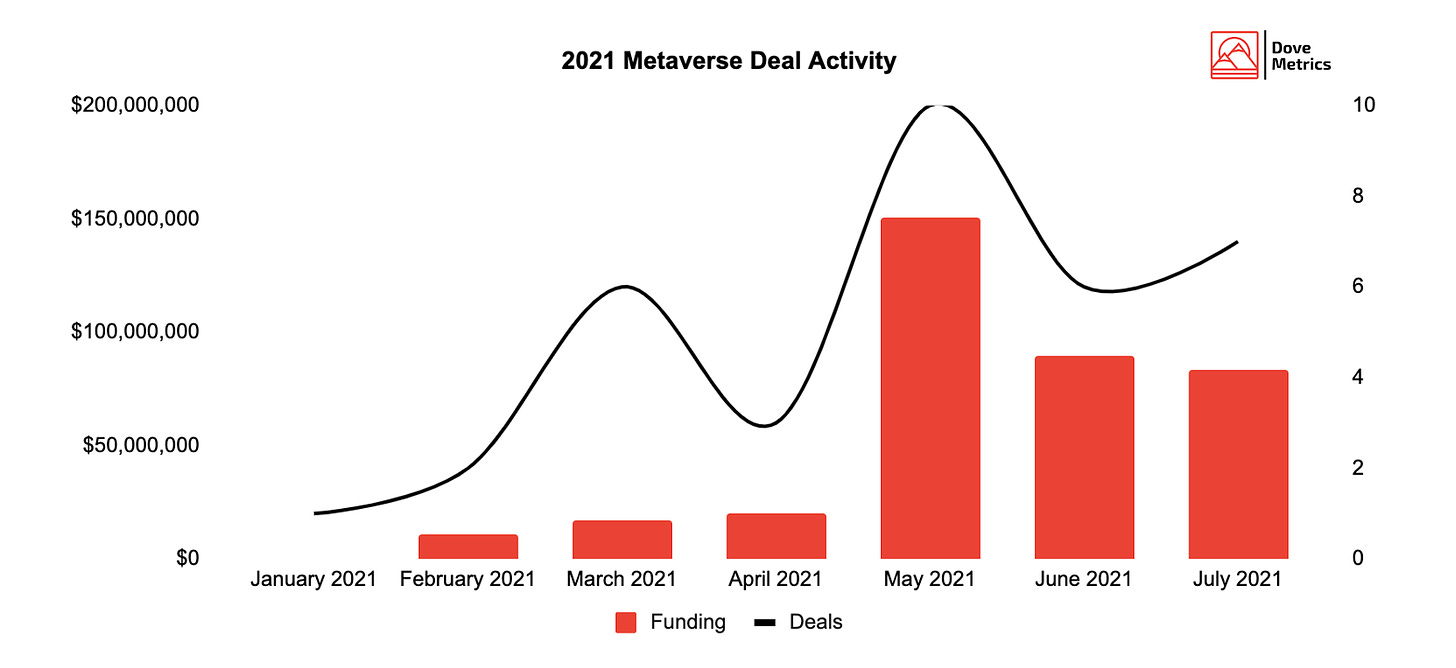

With 35 deals and more than $372M raised since January 2021, Metaverse-focused projects concentrated around 3% of the fresh capital flowing into the crypto industry. Besides gaming, which undoubtedly represents the most widespread access points to the Metaverse, commerce is another incumbent: projects like Spl.yt Core ($2.75M) and Boson Protocol ($10M) are also building future Metaverse building blocks.

$150M was raised in May alone. Larger rounds contributed:

Animoca Brands ($89M) — with participation from Kingsway Capital, RIT Capital Partners, HashKey Fintech Investment Fund, AppWorks Fund, LCV Fund, Huobi, Octava, Ellerston Capital, Perennial, Axia Infinity Ventures, SNZ, Liberty City Ventures, Metapurse, and others

Bitski ($19M) — with participation from Andreessen Horowitz, Kindred Ventures, Galaxy Digital, Jay Brown, Scott Belsky, Dylan Field, Serena Williams, Jay-Z, Ari Emanuel, Mike Krieger, Peter Sellis, Kayvon Beykpour, Metapurse, and others.

Big Time Studios ($10.3M) — with participation from FBG Capital, Digital Currency Group, Sound Ventures, OKEx, and Alameda Research.

RTFKT Studios ($8M) — with participation from Galaxy Digital, Ledger Capital, Dapper Labs, Adrian Cheng, Shrug Capital, Mike Novogratz, Andreessen Horowitz, Roham Gharegozlou, and others.

Sky Mavis ($7.5M) — with participation from Libertus Capital, Collab+Currency, CMT Digital, Animoca Brands, MetaCartel Ventures, CoinGecko Ventures, Dialectic Capital, Hashed, 500 Startups, DeFi Alliance, Free Company, Fabric Ventures, Mark Cuban, and others.

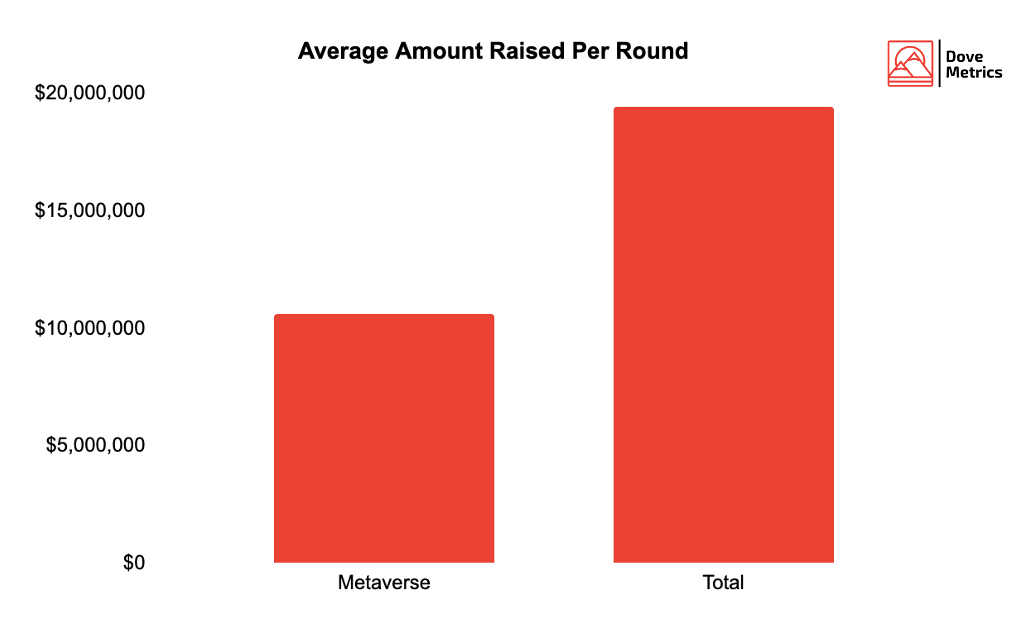

The space is still early - 77%+ of the rounds were earlier than Series A. On average, $11M is raised by a project building in the Metaverse sector, compared to $19M for the industry overall.

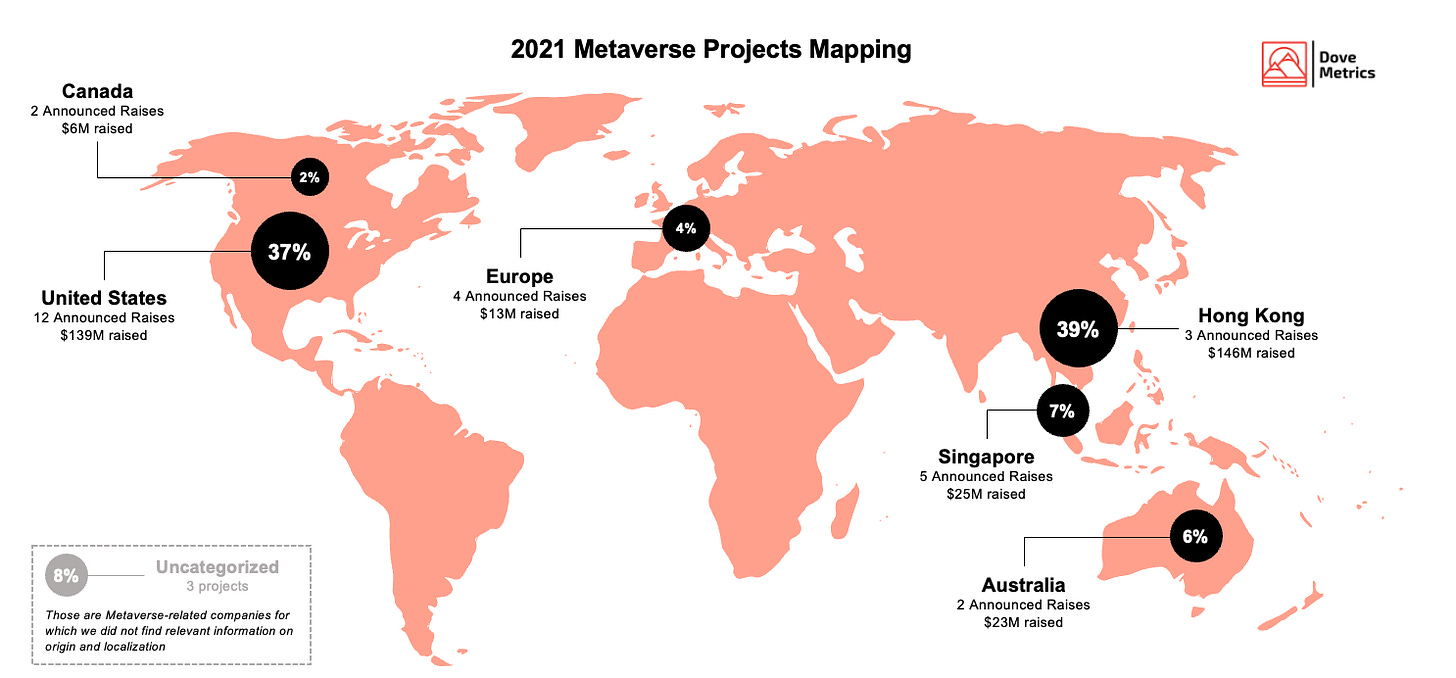

Geographically, crypto Metaverse companies are quite concentrated. As usual, the three major crypto hubs — the United States, Southeast Asia, and Europe — are the most common locations. And 76% of the teams which raised funds in 2021 are based whether in the United States or in Hong Kong.

In late July, Solana Foundation, Audius, and the Metaplex Foundation launched a new $5M fund to help creators pioneer new works in frontier categories like the Metaverse — among others.

Another trend to look out for is funds buying NFTs themselves. Some funds like Metapurse are not only making token/equity investments (Jenny Metaverse DAO, Animoca Brands, Bitski): they get involved in the Metaverse by buying lands in Cryptovoxels, or towers in Decentraland.

Last week 28 projects announced fundraising rounds:

Loda ($15M) | Platform to secure a loan today using your cryptocurrency from 5.9% — with participation from Framework Ventures, Spartan Group, One Block Capital, Mechanism Capital, Liquefy Labs, Apollo Capital, Maven 11 Capital, LedgerPrime, Cluster Capital, Signum Capital, X21 Digital, Flow Ventures, Autonomy Capital, KardiaChain, and Georgi Georgiev.

Port Finance | Non-custodial liquidity protocol built on Solana — with participation from Jump Capital, Rarestone Capital, GSR, Valhalla Capital, Ming Ng, and Raydium.

NFKings | A leading NFT creatives and production company with over 100 intellectual properties (IPs), to contribute to building a sustainable digital creativity space — with participation from Binance Labs.

Tenderly ($15.3M) | Ethereum developer platform that enables you to build innovative blockchain products — with participation from Accel, Stani Kulechov, Guillermo Rauch, Nicolas Dessaigne, Mirko Novakovic, Milos Stojanovic, Captain Nemo, Roxana Danila, Ivan Bjelajac, Marc Bhargava, Point Nine Capital, and Version One Ventures.

Vauld ($25M) | Intending to treat your cryptocurrencies as a separate asset class, and offer services to ensure technologies based on blockchain are usable as of today — with participation from Valar Ventures, Pantera Capital, Coinbase Ventures, CMT Digital, gumi Cryptos, Cadenza Ventures, New Form Capital, CoinShares, and Robot Ventures.

Livepeer ($20M) | Develops and operates a platform for decentralized live video broadcast on the Internet — with participation from Digital Currency Group, Coinbase Ventures, Northzone, CoinFund, 6th Man Ventures, and Animal Ventures.

Horizon Blockchain Games ($4.5M) | Driving Web3 adoption by making blockchain easy, fun, and powerful for users and developers — with participation from CMT Digital, The Xchange Company, BITKRAFT Ventures, Khaled Verjee, and Zyshan Kaba.

Paxos | A regulated financial institution building infrastructure to enable movement between physical and digital assets — with participation from FTX, Founders Fund, Coinbase Ventures, and Bank of America.

AlchemyNFT ($6M) | A platform that enables new utilities for non-fungible tokens — with participation from Crypto.com Capital, Digital Renaissance, Fenbushi Capital, Framework Ventures, Free Company, Hash Global, Hashkey Capital, Huobi Capital, LongHash Ventures, Mask Network, Mechanism Capital, OKEX, Puzzle Ventures, SevenX Ventures, and Mark Cuban.

Lolli ($10M) | Gives you free bitcoin or cash when you shop at over 1,000 top stores — with participation from Acrew Capital, Banana Capital, Up North Management, Animal Capital, Logan Paul, Chantel Jeffries, Lauren Riihimaki, Kenny Beecham, Baron Davis, Seven Seven Six, 3K VC, Gabriel Leydon, Forerunner Ventures, and Formula VC.

Biconomy ($9M) | Biconomy is a developer platform that empowers blockchain developers to enable a simplified transaction and onboarding experience for their Web3 project — with participation from Mechanism Capital, Bain Capital Ventures, Rarestone Capital, Zee Prime Capital, Digital Asset Capital Management, True Ventures, LedgerPrime, Eden Block, Coinbase Ventures, Huobi Capital, Genblock Capital, Chorus One, CoinFund, NFX, Proof, Primitive Ventures, Woodstock Fund, Stani Kulechov, Hasu, and others.

Prime Trust ($64M) | A blockchain-driven trust company that provides API-driven open banking solutions — with participation from Diverse Angels, Kraken, Mercato Partners, Nationwide, Nevcaut Ventures, s20 Capital, SamsungNext, Seven Peaks Ventures, STCAP, and University Growth Fund.

Genesis Digital Assets ($125M) | One of the world's largest and most experienced Bitcoin mining companies — with participation from Kingsway Capital.

Lemon ($16M) | End to end crypto ecosystem for Latin America with an exchange as core product — with participation from Kingsway Capital, Draper Associates, Valor Capital Group, Cadenza Ventures, Draper Cygnus, Coinbase Ventures, and Grupo Supervielle.

Eco ($60M) | Simple balancer that lets users spend, send, save, and make money at the same time — with participation from Activant Capital, L Catterton, Andreessen Horowitz, Lightspeed Venture Partners, LionTree, Valor Equity and Partners.

Valora ($20M) | A mobile wallet that allows you to send, save, and spend crypto as easily as sending a text, powered by Celo — with participation from Andreessen Horowitz, NFX, Polychain Capital, SVAngel, Nima Capital, and Valor Capital Group.

Splinterlands ($3.6M) | A trading card game built on the blockchain — with participation from Animoca Brands, Blockchain Founders Fund, Enjin, Polygon, Yield Guild Games, Gate.io, 3Commas, Alpha Sigma Capital, AGE Crypto, TechmeetsTrader, and Ran Neuner .

Hedgehog ($3.5M) | A lightning fast prediction market that generates passive yield for LPs while providing users a seamless experience — with participation from Alameda Research, Solana Foundation, Reciprocal Ventures, Divergence Ventures, Mgnr, Republic Labs, Switchboard, John Fiorelli, and Chris McCann.

Fireblocks ($310M) | Fireblocks is an all-in-one platform to store, transfer, and issue digital assets across your entire ecosystem — with participation from Sequoia Capital, Coatue Management, Stripes, Spark Capital, DRW, and SCB 10X.

Saber ($7.7M) | A cross-chain stablecoin and wrapped assets exchange on Solana — with participation from Race Capital, Multicoin Capital, Jump Capital, Social Capital, Solana Foundation, CMS Holdings, Divergence Ventures, Reciprocal Ventures, Republic Labs, Coin98 Ventures, Tristan Yver, Jason Lau, Julien Bouteloup, Jeff Kuan, and Ryan Shea.

BitSport | One of the first-ever Peer to Peer Blockchain driven competitive eSports platform opening up several monetization avenues for Gamers and eSports in a competitive, decentralized fashion

Dibbs ($13M) | Allowing users to trade fractional interests in sports cards in real-time — with participation from Tusk Ventures, Channing Frye, Chris Paul, Courtside Ventures, Deandre Hopkins, Founder Collective, Foundry Group, Kevin Love, Kris Bryant, and Skylar Diggins-Smith.

StormX ($9M) | Gamified microtask platform creates opportunities for people around the world to earn cryptocurrency rewards — with participation from Optimista Capital.

Lyra ($3.3M) | A protocol for trading options on Layer 2 Ethereum — with participation from Framework Ventures, ParaFi Capital, DeFi Alliance, Divergence Ventures, Orthogonal Trading, Robot Ventures, Apollo Capital, Magnet Capital, Kain Warwick, Jordan Momtazi, Stani Kulechov, Ryan Adams, Anthony Sassano, Anton Bukov, Jinglan Wang, Kieran Warwick, wsbmod, Hasu, and Tyler Ward.

EthSign ($650k) | A decentralized, versioned, integrable everywhere electronic agreement signing platform — with participation from Draper Associates, Hashkey Capital, and imToken Ventures.

Core Scientific ($54M) | A Blockchain and Artificial Intelligence hosting, transaction processing, and application development company — with participation from Celsius Network.

Freightify ($8M) | A freight quotation software for brokers — with participation from Vinod Kumar Talreja, and Nordic Eye Venture Capital.

IP Assets ($1.4M) | Providing blockchain integration consulting and services for businesses, artists, and Universities

We have also added the following investors: TechmeetsTrader, Animal Ventures, Liquefy Labs, and many angels.

Join our Telegram Group and follow our Twitter account to stay up to date and get notified when content is out!

See you on Thursday for Thursday Thoughts #9,

The Dove Team